ICT Youtube Community Messages

- Day One: Maximum Effort.

- Today should begin your new journey...

A journey of self-discovery & empowerment. This is done with a powerful tool. The secret to effective learning & measuring that progress - is a Journal.

If you do not have a journal, go buy one today. Sometime, during today... sit down and record today's date on the first line.

Then in a brief paragraph record why you want to learn how to trade. Keep it brief.

Then list 12 things you want to achieve in 2021 as it relates to the markets and or trading.

Do not waste this opportunity... it will be crucial on December 31.

- We are going to walk together, through 2021.

When you come out on the other side... you will be better than you are right now.

I promise. Just take my hand... I know my way around.

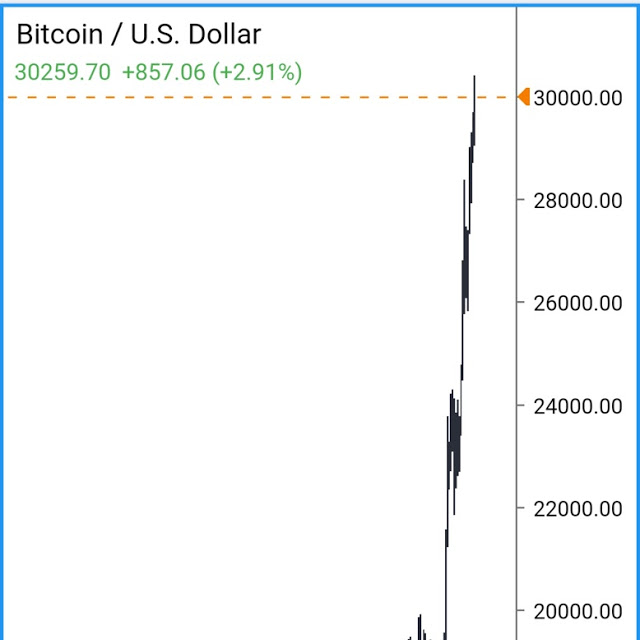

- July 2020 I explained on Twitter that Bitcoin would trade to 30k by 2021. I was off by a day - I stated I would delete all my social media if it didn't. I had already deleted my Twitter and Instagram.

Crypto isn't my thing... but I suspect more people see the nonsense about me as just that. Baseless and envy.

Seeing is believing and 2021 won't be any different.

30k Bitcoin... cheers.

- Day 2 -

Know where your insights come from and filter out misleading or fake education.

Limit your focus to that which is proven. Emotions are distracting... keep them out of the equation.

Keep your attention on the 12 things you set out to learn. I will multiple that list exponentially as the year pans out.

As you were...

- Day 3 -

Are you confident that you are learning things that are real or contrived? You know by seeing. Not seeing examples illustrated but by studying the characteristics of it. Then searching for it on your own... in private analysis.

Do not rely on the hand of others to feed you... you will starve, if you do.

Only the strong survive here.

Stay hungry.

- Day 4 -

Keep your charts organized and neat. Avoid extra distractions and only annotate what is salient to the present market conditions.

Keep your annotations positive and avoid negative remarks like "I am stupid for missing this..." or "why do I keep losing?"

Your subconscious records emotional stimuli that you associate to charts. In response, charts will create fear & anxiety.

This promotes analysis paralysis. When your annotations are positive it will be a constructive criticism that you will remember subconsciously and it won't be a hindrance to your development.

Day 5 - We do not play lottery with price charts. We focus on the low hanging fruit and in the proper context.

We do not force or gamble on a "what if" setup. It is a low resistance liquidity run or it isn't. There is no debate or confusion.

We hunt soon.

As you were...

Day 6 -

All eyes on US election theater. Expect shenanigans & flags. Nothing else matters today.

I am not here to make friends. I don't believe I will convince everyone because many are too lazy. They will not test what I say and teach here for free. It is easier to take the opinion of strangers on the internet than to do their own due diligence on the matter.

If I make money trading it is called fake. If I make money teaching, they call it my only means of income. They say my concepts are copies of retail garbage... but not one person can make the case for this. I will pay 100k to anyone who can... period. Make it 250k now.

If I am only living on Mentorship millions - pray tell, why am I turning off the million dollar money stream in 2022? You people are ridiculous that spout this kind of nonsense lol.

Screenshot this post. If I offer Mentorship in 2022, make videos, share it everywhere. It would be proof I can't feed myself without it... and I can't be trusted.

Fair enough?

Winter is coming...

Day 7 - Today is just one day of the rest of your journey. Yesterday's results do no limit you or define your destination.

Keep the focus on the process. Submit to the time required. It will come.

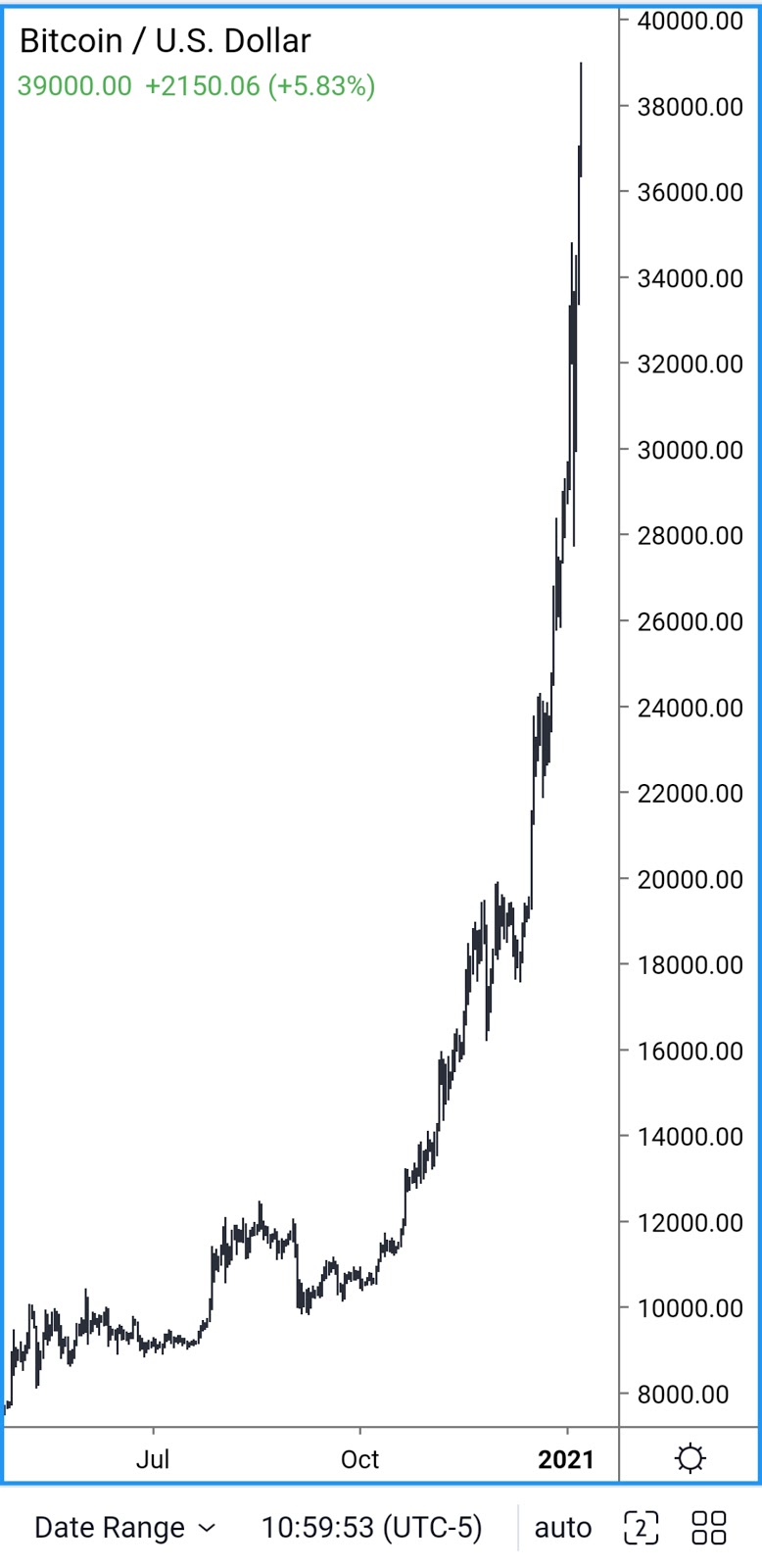

Meanwhile... Bitcoin 39k... remarkable.

Elon Musk passed Bezos 188 billion Net Worth.

Remember that TSLA buy in October 2019? It traveled a lot since then.

Bread and Butter pays the bills, mega trades pay for the lifestyle.

Gold is a manipulated market. I pick my times when trading that metal. It is an event specific market, in that, it requires some event. It is not so much a value market. It is many times, used to trap neophytes in moves that get hyped by advertisers and metal brokers.

I am neutral on it at the moment.

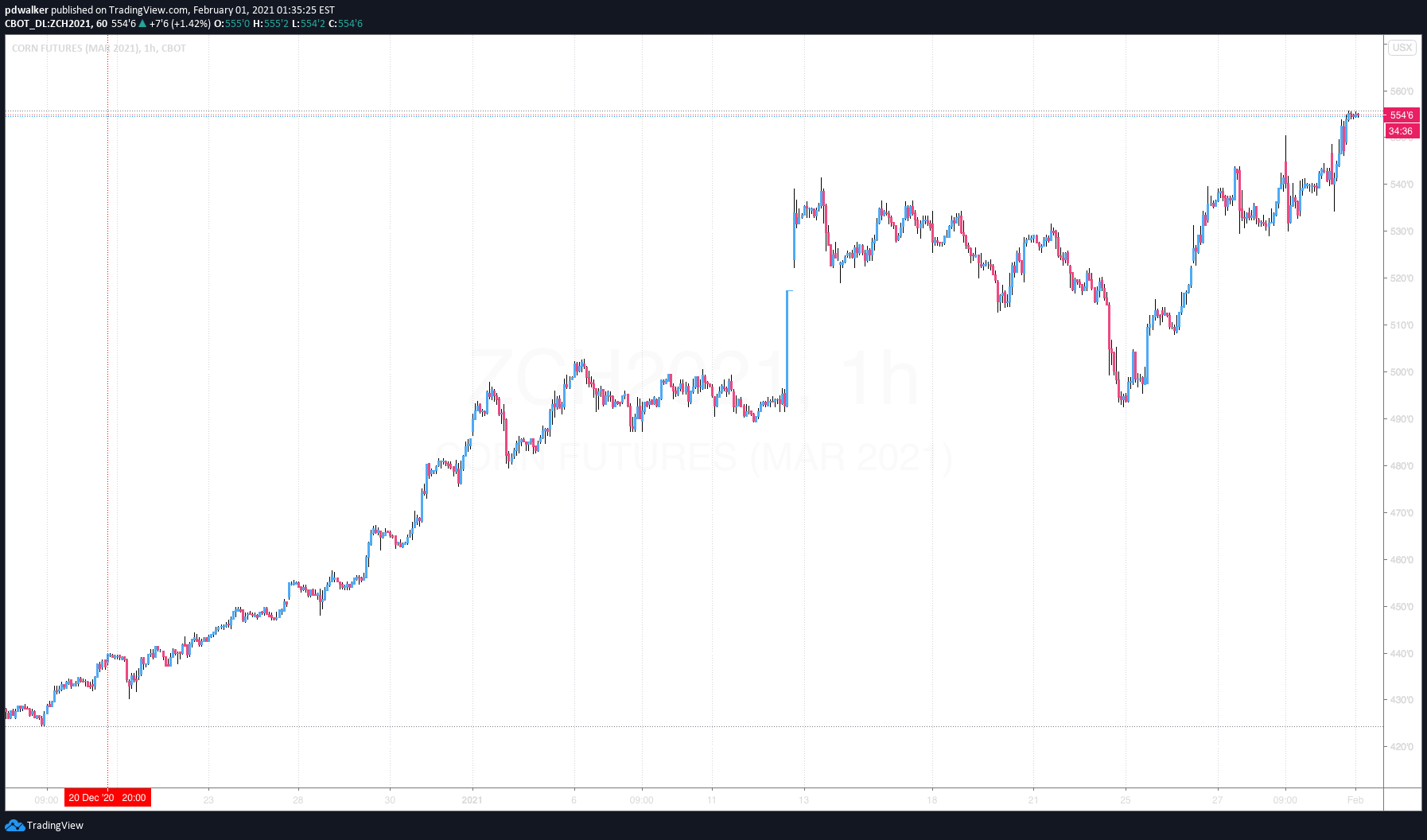

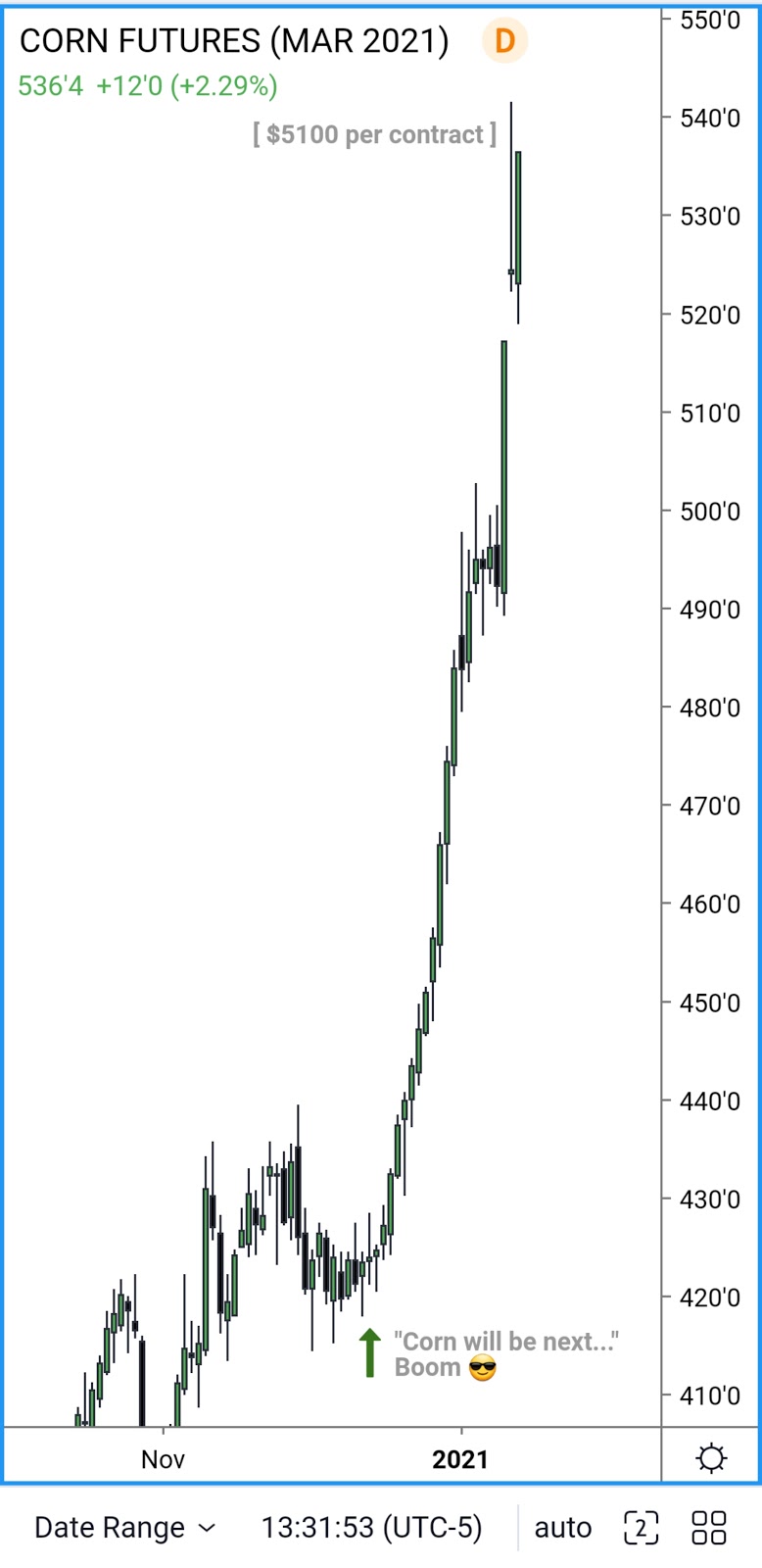

Do some research on Grain reports. Soybeans, as I stated since June of this year, is poised to continue to rally into 2021. Corn will be next. Why?

China is buying everything they can. Soybeans is used in many processed foods and are used as livestock feed. If Soybeans are low on supply - feed will switch to corn... then that grain will go into low supply.

Wheat will be a grain that sees higher prices in 2021. Food will be the fear and concern in 2021. Russia has made it known they will consider export tariffs on wheat.

Think food futures... that is the next "Bitcoin" mega trade.

As you were...

Go to Tradingview and enter ZCH2021 to see how Corn Futures responded on this call. December 19, 2020. That is a 3k per contract move. "Smart Money" is not limited to "one" market.

You don't like to scalp intraday? Day trading feels too fast for you? Short Term requires too much day to day analysis? Swing Trading might be your style. It is all relative... I have an approach in all disciplines... just match your personality to the method that best suits you.

Never let me, or any educator, force you into an analysis approach that does not fit your style and personality.

When you find what fits you... your emotions and trade psychology will not hinder your progress.

As you were...

Day 8 - New beginnings are both exciting and frightening. On one hand, you want to get started on the right foot and see results quickly; and at the same time, you don't want to make mistakes. I want to remind you to invite the mistakes early on. These are your opportunities to learn.

The pain and discomfort you are trying to avoid is the smoothing out of rough edges in your skillset. Do not try to avoid this... it is crucial to submit to it. There is no ego involved. There is no reason for you to fear doing something wrong. This is the natural result of feeling rushed to trade with live funds, when you are not ready.

Anyone that says you will learn how to trade consistently, profitably and free from the chains of fear and greed in any time less than 2 years, is lying to you and doing you a disservice... avoid them. Honestly.

If you disagree, come see me in less than 2 years with your millions.

18 days to go before the final ICT group begins their journey into the depths of my experience, concepts and cerebral cotton candy. I am excited for you... use this time to obtain a few notebooks. Get a good spreadsheet application like Excel. You will want to log lessons and details from them, so you can find them for your reference, as you go through the Mentorship core content.

I will outline how to do this when you begin, don't worry about it right now. Submit to the processes I give you and stick to them, and you will get here. Those of you that went through Core content, you will do well to follow my lead this time around. You missed a lot, in your haste.

Tomorrow closes the door for enrollment interest. I realize some are not going to meet this deadline for various reasons. To those who are in this circumstance, I understand and apologize. Please understand, like you and your life requirements, I have mine too. This Mentorship requires nearly all my conscious time and is very taxing. If you knew how much goes into managing it, you'd understand.

It is not personal, it is not cruelty or selfishness... I am in need of returning to my preMentorship life and pace. My hope is this does not turn you off to learning what you can here. I will do my best to share lectures on this channel when my time permits it in 2021, but I can not commit to anything with so much expected of me already.

When my commitments are serviced, I will return to a more frequent Youtube pace. If you respect me, you will grant me that. I believe I earned that much.

Besides, you have yet to master what is here for free... get busy.

Day 9 - The first full trading week of 2021 is in the books. It is important to note, every year, the initial weeks of January are slow. I do not mean that opportunities can not be found, but rather, big institutionally sponsored swings are not typically expected.

With the exception of Bitcoin, where all the attention and excitement has been... the markets appear to be delivering on their typical seasonal tendencies.

Retail traders are frothing at the mouth to get in new trades. Smart Money uses this month annually to study what sentiment and any macro influences are in play. If that is the norm, do likewise and wait.

Wait for what? New market structure insights after an initial displacement in price. It is important to hold end of year biases loosely, into the month of January. This permits flexibility in new year analysis.

Why is this important? Patience & sound logic.

I lost a lot of real money, in my early days, forcing a view into a new year. I was too busy looking for evidence I was right, instead of, reading what the market was actually telling me. Often, in those early years of my development; it was telling me that I was wrong, but I was hell bent on being "right"... so much so, I couldn't see it.

Be willing to be wrong... it is less painful and allows your analysis to be more fluid and by default... makes you better for having done so.

As you were...

Day 10 - While taking on the challenge of learning the fine art of effective analysis in Price Action, there are a few things to keep in mind.

There will be a lot of theory in the development stage of your learning. It will seem like an ever increasing amount of moving parts. This is much like watches.

If you want to wear a watch for the purpose of telling time, just about any watch will do. If you want Swiss Craftsmanship - this suggests that you care more about precision and quality... in telling time.

To appreciate the precision of a fine Swiss Timepiece - you study the intricate placement of every small component. The artistry and masterful design of every facet inside the watch.

Do you need a Patek Philippe to know what time it is? No. When you find the appreciation for telling time with class & precision... you choose Swiss Craftsmanship and it comes with a price.

The price in knowing precision in Price Action is lots of theory and appreciation for the details. These are found in "boring, dry lectures". It only feels boring because you want the action points... the triggers... the signals.

However, you need to understand how to anticipate the effects of many circumstances in the markets, before you can reasonably expect to have consistency in your skillset.

This requires dedication & submission. Time is the currency required. If you bring a Casio level time investment to the table but want Rolex results - you will be disappointed.

Precison is not required to profit. Sloppy analysis, poor executions on entries and exits; can still result in profits. How you endure these transactions of "time", is the difference between Casio level and Patek level precision.

Do you feel anxiety or impatience in your setups or is it just another transaction you participate in? One that you studied intimately and understand the details or "craftmanship" in its logic and delivery?

Or are you just looking for a "time" to push enter and hope it pans out for you?

There is a difference and it is not founded on randomness or luck.

Choose precision and experience artistry in analysis. You won't regret the effort and time invested, to acquire it. Then onlookers will appreciate the craftmanship of your skill, like that Patek receives and Casio won't be given a second glance.

As you were...

Day 11 - It still works... and handsomely, I might add. Do not fear the uncertainty of the present. Wealthy people have wealthy tools that they will protect to keep them wealthy.

Markets may see sudden adverse moves but these are opportunitites... not dismantling of the tool.

Keep emotions out of it. Keep risk low.

As you were...

Day 12 - When a student endeavors to learn how to read Price, it begins with a Macro Perspective. This is not merely a Higher Time Frame Analysis but rather Seasonal.

How a market tends to deliver during a specific time of year, is beneficial to the fledgling student. While Seasonal influences are a powerful tool in analysis, they are not a panacea.

Although, Seasonals are not a "be all end all" silver bullet for Price Analysis - they do provide a general roadmap in many ways. However, in periods when a market tends to seasonally perform one direction but shows a divergence from the seasonal... this can hint at a stronger counter seasonal price event.

A departure from the norm, in Price Action, tends to incite excitment in Price and opportunities. Far more importance should be placed on this area of your study, than that of entry patterns.

It matters far less "when" you enter, if you have the underlying basis for a directional price run incorrect. This feels counterintuitive to the new student. They want to be a sniper and pop shots like an elitist technician. However, they don't consider the effects of seasonals on their "money shot".

The secret to precision placement on your entries and low drawdown is rooted in being on side; being dialed in on your market. You get there by knowing the Macro phase first. Then reducing all your tools and navigation in lower timeframes with that premise.

If the perspective is unchallenged or in essence "onesided"', you have optimal conditions... squeeze the trigger. When you don't, wait for a cleaner shot.

As you were...

Day 14 - Two Weeks into the new year, how are you doing with organization? Are you finding it difficult to stay focused on the task of journaling?

If this is you, keep doing it. New habits take time to develop and then results will be measurable. Comparing your progress to when you were not trying... is a bit premature.

It is much like doing squats your first few times. It is painful and walking stairs becomes next to impossible. It is easy to think, why am I putting myself through this? Is this pain worth it? Yes, yes it is. Suck it up.

The things you are doing are going to elevate your ability to decypher Price. You have to adhere to processes early on, that will feel like dry and boring routines.

These practices of logging observations in charts and marking up hindsight fractals, annotations of your remarks that are based on your level of understanding... all of it is crucial.

Without this process, you will not have a measuring stick or baseline to evaluate your development. You want to have data, visual aids, actual evidence that your skill is indeed improving.

Like squats, it only hurts initially, but months from now... you will see the results; that only feel like agony and pain inside early on. Keep pushing through.

Over time, you will come to enjoy journaling Price and observations. This is the stage right before you start to see things before they unfold in Price. Then you will be an addict.

You will not doubt yourself at that stage, you will laugh at naysayers that doubt you or your pursuit. It will become clear that those who try to detract and distract you from your goals... are a waste of attention.

This will further increase your drive and focus... in solitude. Early on, your weakness and uncertainty will crave companionship. You will seek to be part of a tribe or pack and have a hive mentality. Avoid this... learn to walk alone.

None of these chat rooms will actually aid you. It is like holding hands with an abuser. It is holding the problem and hoping it changes for the better and that you might benefit... but it never comes.

Study alone, this develops confidence in yourself. You can do this, if you listen to me. You are all that is required. No one will push the trade execution for you, no one will enter your stop loss, no one will close your trades for you.

So why are you inviting the illusion that people who know nothing about you or how to trade... will have a positive impact on your development? This is codependency and it is poison in trading. Stand alone. Collect the glory solo and share it with no one.

It is you that busts your ass to learn this. It is you that grinds through, despite it being hard and long before results can be seen. You are the one who gets down to work with studying and doing what is necessary to succeed.

Everyone else will be making excuses why they failed. Everyone else will be huddled up in chat rooms with an open outstretched hand, begging in silence for a crumb. They will starve, while you feast on opportunity.

Do not feel compassion for them, they know what they are doing is not the way. They want an easy walk, a free ride to profitable living and it never comes that way. It is earned with pain and sacrifice - by doing without all the distractions.

Only the strong survive here. Only the strong get it. The weak will talk nonsense, when it is too hard for them to stay on task and learn it. You are not weak, you are not entertaining fools. You have a vision of your life and you found your path to reach it.

Stay focused on you. Everyone must fend for themselves. You eat by your own hands... you gather experience independently and this is a resource that is intimate and can not be shared or deposited into another. You, like everyone else, must bust their ass for it. Now get back to work.

As you were...

Making Money Moves With ICT...

Click the image to maximize.

Day 15 - Change is coming... ready or not. Make yourself ready. Give yourself every advantage possible and purge every waste of time and money.

Enjoy this weekend. Enjoy family. Rest.

Next week may be eventful for all of us.

What is a realistic goal for new Traders, that have discovered their unique model?

2 to 3% a month, at first.

When this becomes consistent, you aim for 4 to 6%.

Gradually increasing over time... not rushing to make double digit percentage per month.

Submit to time and experience will empower you to do well. You think this is slow and holds you back. It doesn't. It prepares you for the exponential effects of compounding.

Compound interest is amazing and while it can be a fast elevation in equity, so can the downside be... on the opposite extreme.

The time you think you wasted by going slow, will be made up for quickly; if you do it correctly. Rushing will only guarantee you get further behind and less net profitable.

Just ask every Trader that rushed to live funds. It is the same story... same outcome. Those that are consistently profitable are the ones who went at a gradual pace.

Do you think they care who thinks they did it wrong? The opinions of many, who aren't profitable, are useless. Follow the advice of those who do, can and will in the future.

Instagram is not wealth instruction. It is fraud and deception and luring the unlearned into traps that neither their pockets can afford or their psyche.

As you were...

I don't buy video likes.

I can afford to wait for real ones.If you get insights from a YouTuber, you should give them a thumbs up. It is free, it took them time and energy to produce it. It takes you nothing to click it.

Too many entitlement minded people are selfish and ignorant to merely consume and give no thanks. I demand it now. It is not a bribe as losers would state.

I don't care if I ever produce another YouTube video - but I will when my recent video shows 7500 thumbs up. This grows the channel and you give appreciation for my time.

I wasted thousands of hours of my life on undeserving viewers. Interactive participation controls my pace of how fast we get to the next video upload on here.

I don't do things traditionally. Why? I am already here. I take chances with my image and do things that others would never do, because they aren't in a position to do so. Everyone else has to post daily to eat... they depend on ad revenue. I don't.

Who walks away from easy millions? Who says they won't do until the audience shows support for the time in effort? Who calls the major moves and publicly... for free? Just me baby... just ICT.

Give and take. There is an exchange expected. Don't be sour, participate... and be patient.

My time is worth something. Don't complain if you are asked to do the least in exchange for it.