OTE Pattern Recognition Notes

Optimal Trade Entry Primer

- one of many trading patterns, one of the easiest

- trading plan needs to be simple:

- what's your risk model

- how to frame that?

- what makes your entry

- what gives you indicators of bullish/bearish market?

- how do you execute the trade?

- how do you manage the trade?

- where do you take profits?

- what make the market predisposed to go higher or lower?

- look at HTF (M, W, D, 4h) and look for key levels where price has moved away from in the past

- HTF shows where the big players are most likely going to push things around.

- LTF is too noisy to show this detail.

- Assuming bullish market, we are looking for where the market wants to trade higher. OTE is based on buying during the retracements that occur before the further push upwards.

- The impulse move has to incorporate a break in Market Structure.

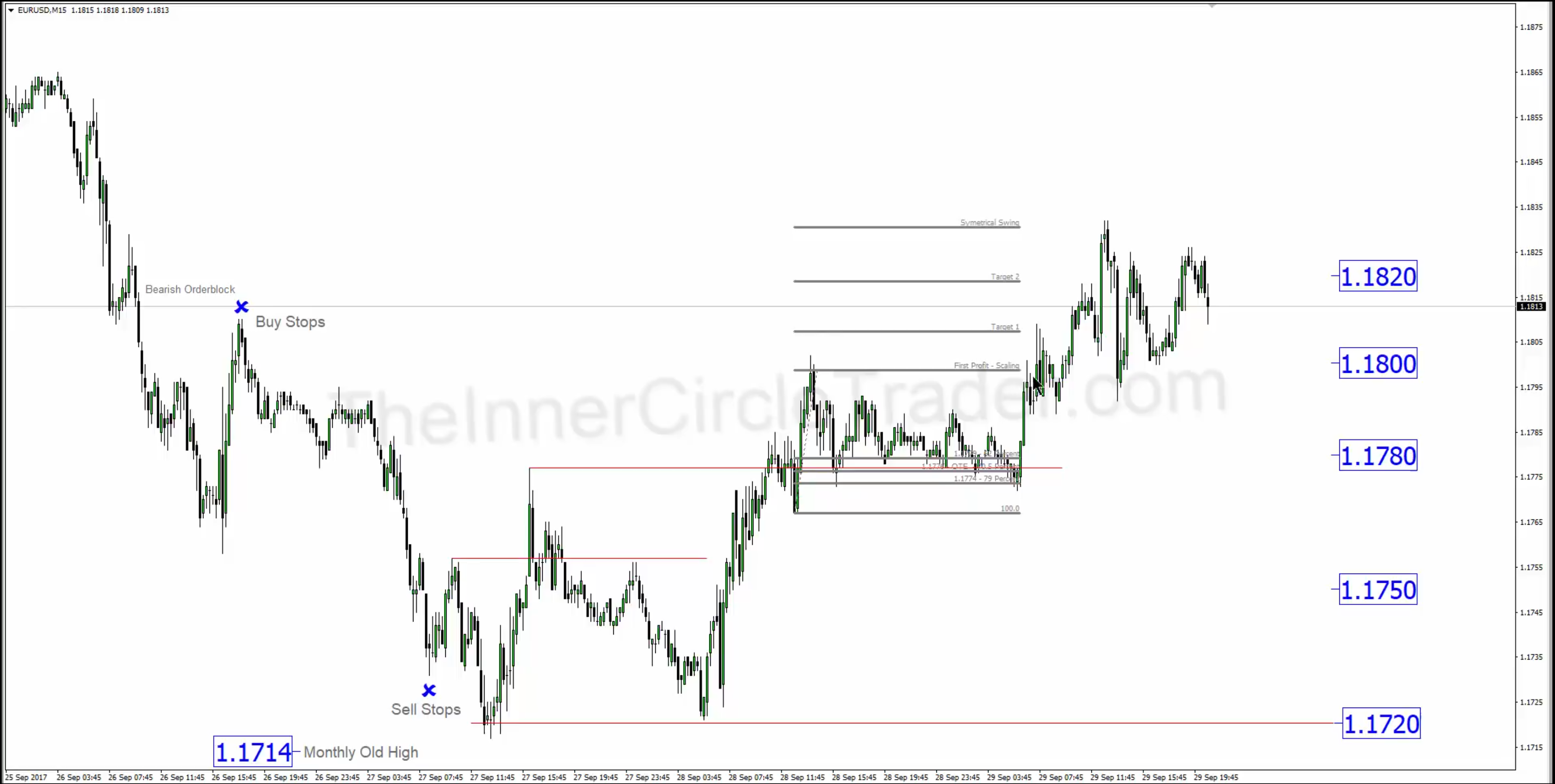

- Using Fib Retracement as a visual guide, set the following levels

- -1 - Symmetrical Price Swing

- -0.62 - TP2

- -0.27 - TP1

- 0 - First Profit - Scaling

- 0.5 - Equilibrium

- 0.618 - 62% retracement

- 0.705 - OTE 70.5%

- 0.79 - 79%

- 1 - 100%, or likely SL

- OTE (70.5%) is an ideal target. getting deeper is better, but you run the risk of not filling your order. 62% retracement is also acceptable, but it results in smaller profits because our SL range will be larger, necessitating smaller order sizes to maintain our risk profile.

- First Scaling, or slightly before, represents the place to take initial profits. It should be a decent return, preferable better than 1:2 risk/reward, but slightly less than 2 (1.5? 1x75?) is also acceptable.

- Setups on 1h charts better than 5m charts because the pip movements will be larger.

- Key levels xxx.00, xxx.20, xxx.50, xxx.80, yyy.00

- Place the fibs on the body of the candles

- Market structure - example given:

- monthly view

- daily view

- 15m view

- Note the following:

- institutional levels

- old monthly high at 1.1720 (1.17137 rounded)

- price runs down until it hits the 20 level (1.1720), rallies and creates a new short term high (old - middle red line, new STH, top red line. It's also called a "market structure break"

- the new STH makes for a more likely trade opportunity. (market maker model) and opens up the chance for an OTE.

- also, a high, with two lower highs on either side makes that high more significant. when this high is broken, it's a more convincing move than breaking the other shorter term highs, thus giving us the opportunity to find a likely OTE.

- at the fib, we see price rockets away from a STL

- when old highs/lows are broken, trades will tend to reach back to those old positions (retail calls it "support")

Introduction

sdfg

Example 1

Example 2

Example 3

Example 4

Example 5

Example 6

Example 7

Example 8

Example 9

Example 10

Example 11

Example 12

Example 13

Example 14

Example 15

Example 16

Example 17

Example 18

Example 19

Example 20