ICT Youtube 2020-08 Notes

2020-08-07 - What Journals I Use and An Example Entry

2020-08-10 - ICT Forex OTE Example - EurUsd

Daily Chart - Day of interest marked

Short term was bearish on that day with what looks like heading into a period of consolidation.

Questions

- can we confirm via Dxy or EurGbp cross as to what is likely to happen?

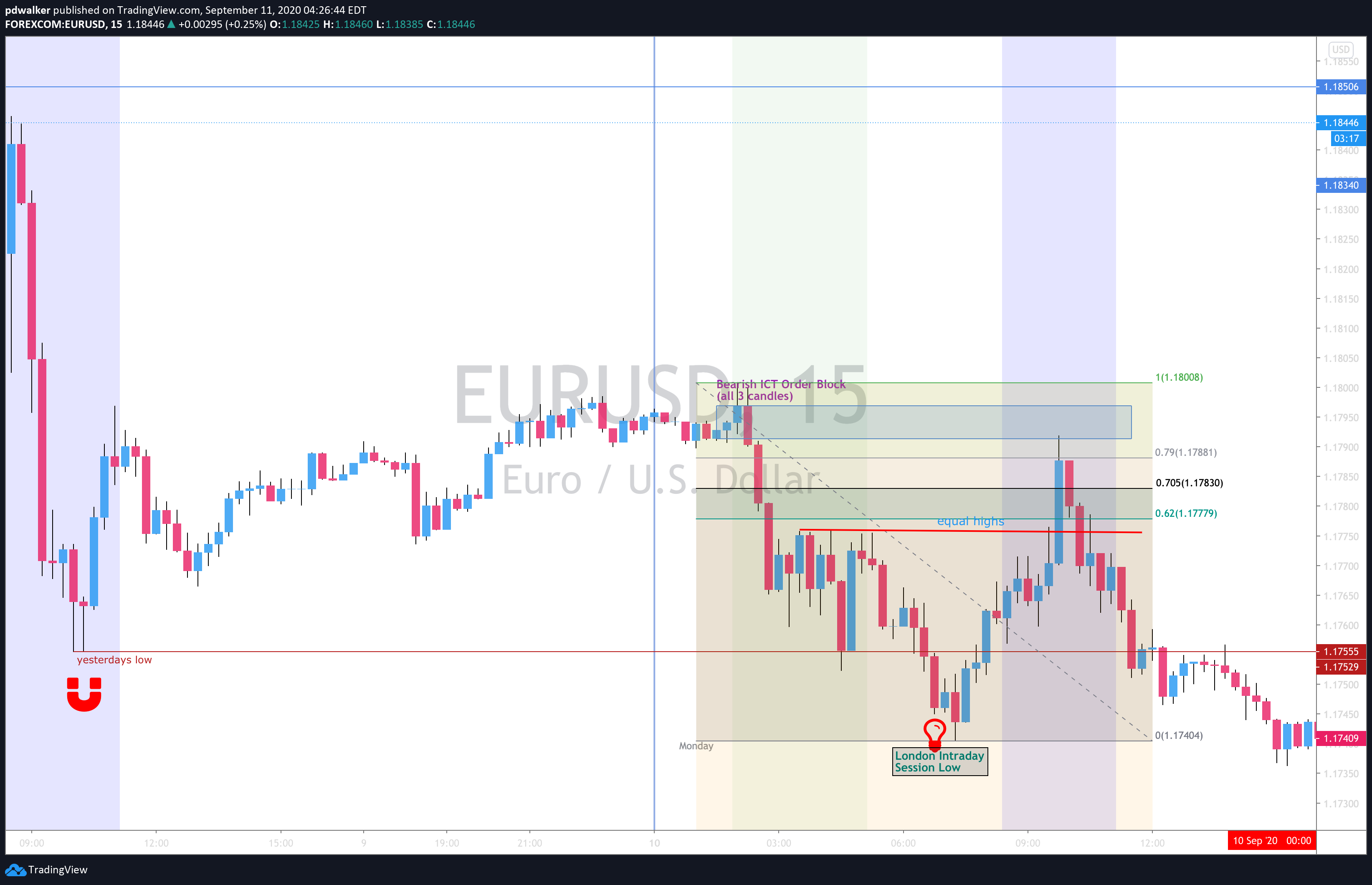

15m chart - OTE sell entry

Observations:

- Previous Friday's low will act as a bearish draw towards price

- The equal highs will act as a short term bullish draw towards price

- OTE setup using the London opening high and the London Intraday Session Low. OTE Sell entry at the 0.62 fib. Targetting the London session low

Entry Stop TP drawdown time 1.1778 1.1801 (21 pips) 1.1740 (38 pips) 12 pips < 6 hours

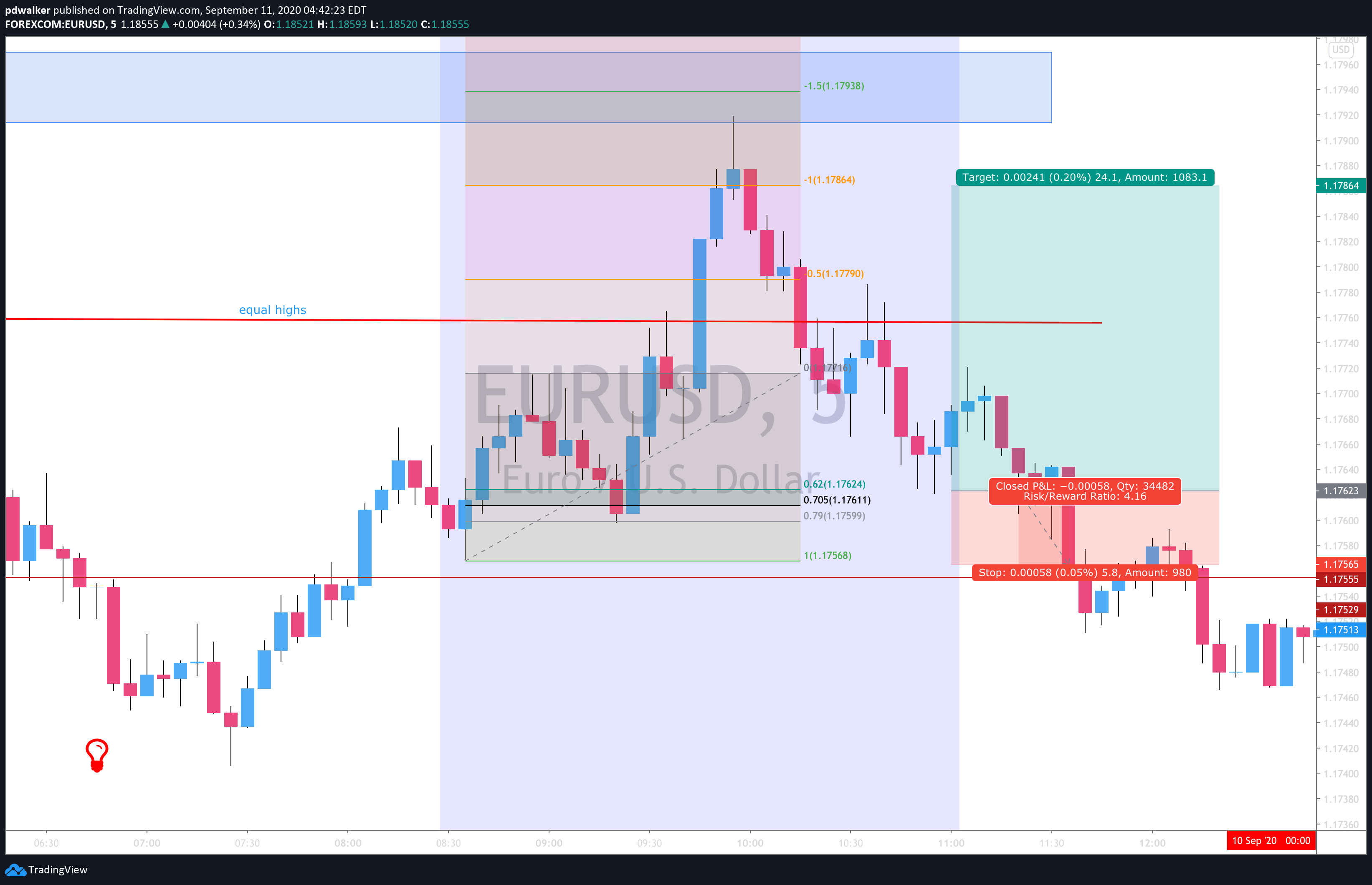

5m chart - OTE buy entry

Within the NY OTE session are two OTE Buy entries that are counter to the daily trend. Second one is marked on the above chart

| Entry | Stop | TP1 | TP2 | TP3 | drawdown | time |

|---|---|---|---|---|---|---|

| 1.17608 | 1.17568 (4 pips) 1.17516 (9 pips) | 1.17757 (15 pips) | 1.17883 (27 pips) | - | 1 pips | < 2 hours |

| 1.17624 | 1.17568 (5 pips) 1.17516 (9 pips) | 1.17757 (15 pips) | 1.17867 (24 pips) | - | 5 pips | < 1 hour |

2020-08-11 - Forex London Close Homework - Silent Study

2020-08-12 - ICT Forex Price Action Lesson - EurUsd MRP

2020-08-17 - ICT Forex Trade Example - EurUsd New York Open

2020-08-18 - ICT Forex - Institutional Concepts and Market Making Insights In Action

2020-08-21 - ICT Forex Price Action Lesson - IPDA Vs. Wyckoff Theory

2020-08-25 - ICT Forex Lesson - EurUsd NYO Lecture