If I Could Go Back and Tell Myself What I Know Now

Part 1 - Where Would I Focus

- Don't Seek the Approval From Others

- People will not understand and will impede your progress with negative reinforcement. No one cares, or will be jealous of what you are trying to do. Do it for yourself, not for anyone else.- Family

- Friends

- Co-Workers

- Strangers

- Learn Risk Management First

- You will lose money. That's the only guarantee.- Appreciate % Over $ Gain/Loss

- the dollar amount doesn't matter as much as the % - Learn to Limit Trade Frequency

- Don't turn a win into a loss. The more trades you make, the more losses you will get - Avoid Short Term Into Long Term

- That's a good way to turn a winner into a loser. Stick to your rules and targets. - Be Content With Enough

- Like #2, you're going to push your luck and lead to more losses.

- Appreciate % Over $ Gain/Loss

- Prevent Life Imbalances

- What's the point if you're ignoring your family? This profession will suck your life away.- Manage Family Time & Schedule It

- This should always be first - Keep a Study & Trade Schedule

- You don't want to become an addicted gambler. Keep a schedule. - Off Days are OFF Days

- Stick to it, or you'll lose your family time bit by bit - Be Patient With Your Development

- Be realistic with your goals, but it takes time. But it's not worth what you will lose, and that's time you cannot get back regardless of the amount of money you earn

- Manage Family Time & Schedule It

- Stop Buying Retail Logic & Tools

- Retail logic is designed to make you fail, so why buy them?- Stop Wasting Money On Books

- They don't have the secret. Good books? Consider (need to check all these references)- For money management, everything from Ralph Vince and Ryan Jones, they do a lot of "optimal f and kelly criterion" (check, not sure what this is) - advanced topic

- How I Made One Million Last Year Trading Commodities (1973) by Larry Williams - most of which is still relevant - teaches about smart money and how it influences the market. Advanced techniques

- Trading for a Living: Psychology, Trading Tactics, Money Management (1993) by Alexander Elder

- Market Wizards 1 and 2 just for inspiration

- Street Smarts: High Probability Short-Term Trading Strategies (1996) by Linda Bradford Raschke and Laurence A. Connors

- Technical Analysis of the Financial Markets (1999) by John J. Murphy - Retail Traders bible - do the opposite of this and you will find the charts more fun to watch because of the high degree of failing.

- Avoid Looking for Hot Hand Gurus

- you won't make money doing this. At best, you'll become codependent instead of a thinking trader - Become Your Own Signal Generator

- you have to learn, and then trust your own judgement, otherwise you end up stuck looking for someone else to tell you how to trade - and that'll lead to further losses. - Be Willing To Lose... A Lot Early On

- it's part of the learning and you don't know what you're doing.

- It's unavoidable and you'll be wrong a lot.

- Don't trade with live funds until you know what you're doing. You cannot lose money this way.

- Losing is normal. Control them, and over time you'll make more than you'll lose over the long term

- It's ok to lose, as long as you continue learning to avoid the mistakes you previously made

- Stop Wasting Money On Books

- Stay Away From Social Media Drains

- don't let others influence your trades. make your decisions. if you let others control your trading, it will lead to further failures.- Don't Join Trading Clubs

- Don't join the hive. everyone has their own trading profile and the group may not be your own style. make your own analysis - Don't Subscribe To Alerts

- Just like taking signals, it takes the power of the trade away from you and into someone else's hands. Be responsible for your own trades. Otherwise, you are gambling. - Don't count other people's money.

- You will never learn to trade doing this. You will not develop the skills. You're chasing other people's money. You can't spend their money. - Don't Feel Insignificant By Contrast

- measure against your own success, not the success of others. Not everyone is what they claim to be

- Don't Join Trading Clubs

- Match Your Style To Your Personality

- Learned from Larry Williams.- Scalp If You Make Quick Decisions - If you're a scalper, you'll do great if you make quick decisions. Don't do it if you can't

- Short Term Trade If You Can Sleep - If you can hold a trade overnight without losing sleep, then you can short term trade

- Don't Force Yourself Into Any Mold - Be what you are, and maybe develop the other skills later

- Don't Try To Copy Someone - they are not you, you are not them. Their strength are not yours. Develop or refine your own models

- Don't Change Trading Approaches

- Stick With One Approach - master it, it takes time

- Avoid System Hopping - you will never master it.

- Every Model Loses - Accept It

- Find Your Unique Model & Grow With It - Don't tweak it too much once you have it working and is profitable, but work on more advanced money management techniques instead. If your method wins more often than it loses, better, more advanced money management will greatly improve your bottom line

- Settle One One Trade Setup Initially -

- Determine Your Asset Class - Pick an asset class and stick with it. Then inside that class, pick one market and stick with it.

- Outline When You Want To Buy - what is the criteria that you feel comfortable for a buy. Detail your plan, on paper.

- Outline When You Want To Short - The same thing applies to shorts. What are the characteristics and circumstances that would make you short? Details.

- Build Many Study Journal Cases - Many examples of when it worked, and when it didn't. The more examples the better. Thus you will train yourself to recognize when the setup happens in live trading.

Part 2 - How Would I Study

(this video should be viewed multiple times)

you will lose trades - doesn't matter. Focus on the re-occurring setups

- Where do steady setups form? Focus first on the following because everything else is a distraction. If you understand how prices flow around these various areas, you will always be able to find setups that will lead to profitable trading.

There are 4 areas that we need to examine:- Monthly Highs & Lows

- Weekly Highs & Lows

- Daily Highs & Lows

- Session Highs & Lows

- In detail:

The open/high/low/close for a period needs to be focused on.- Monthly Highs & Lows

- Look at the last 3 months - mark out the high and the low and then study how the market reacts around it. Ignore standard support and resistance crap because that will lead to loss.

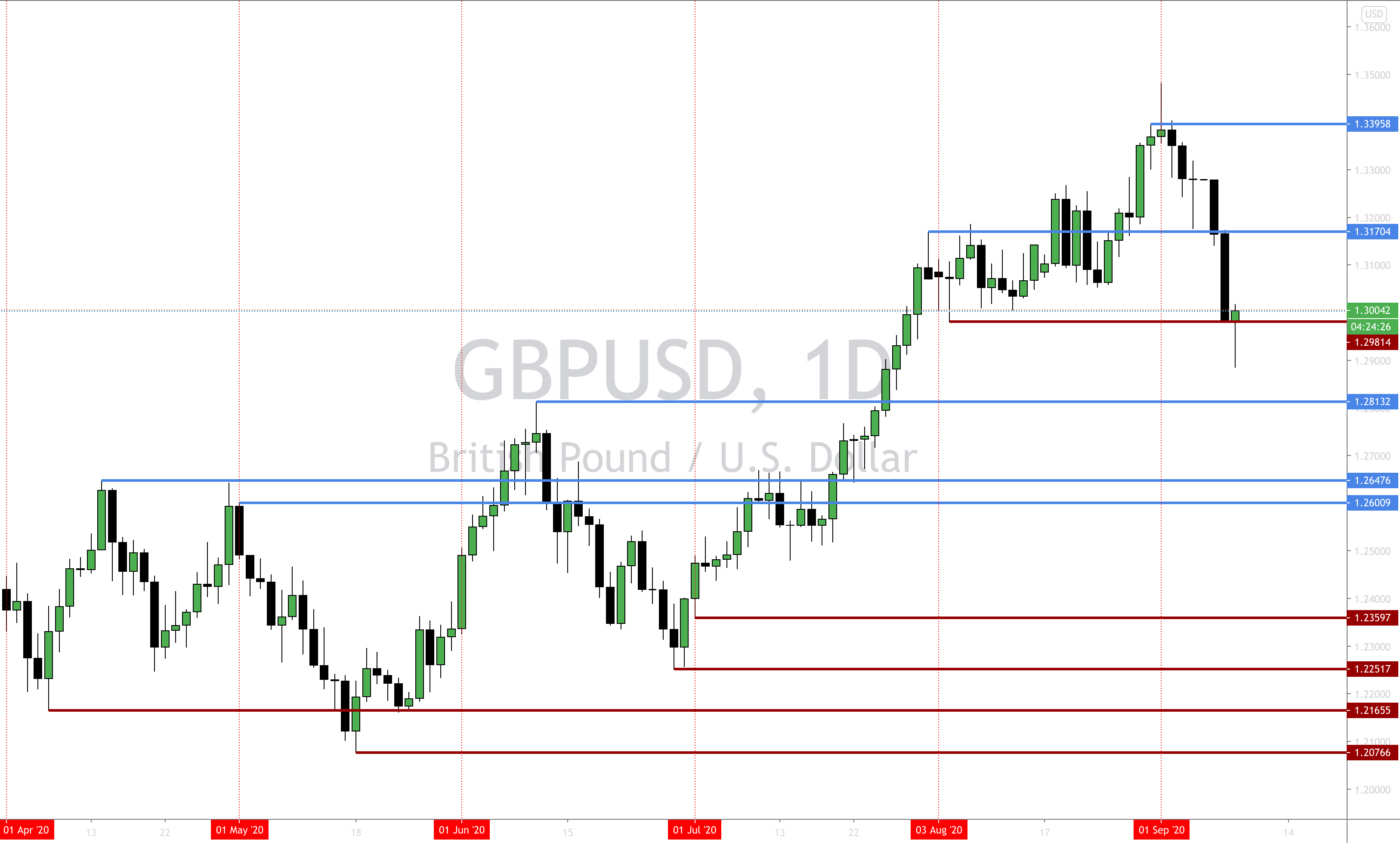

- Example marked out - daily GBPUSD Apr 1 2020 to July 10 2020:

- Mark out the monthlies and extend it out into the future.

- What's happening and is happening as it reacts around that price level? Is price heading for an old monthly high? Low? Where is it aiming? Has it recently gone below an old low? and rallying up? If so, it's probably just ran stops. If it ran sell stops, then it'll probably run for the old monthly highs.

If it's reaching for an old monthly high - then the algorithm is reaching for the liquidity resting above those old highs.

If it's reaching for the old monthly lows - then it's reaching for the liquidity resting below those old monthly lows.

"to and through" - important words and we shall see later.

- Weekly Highs & Lows

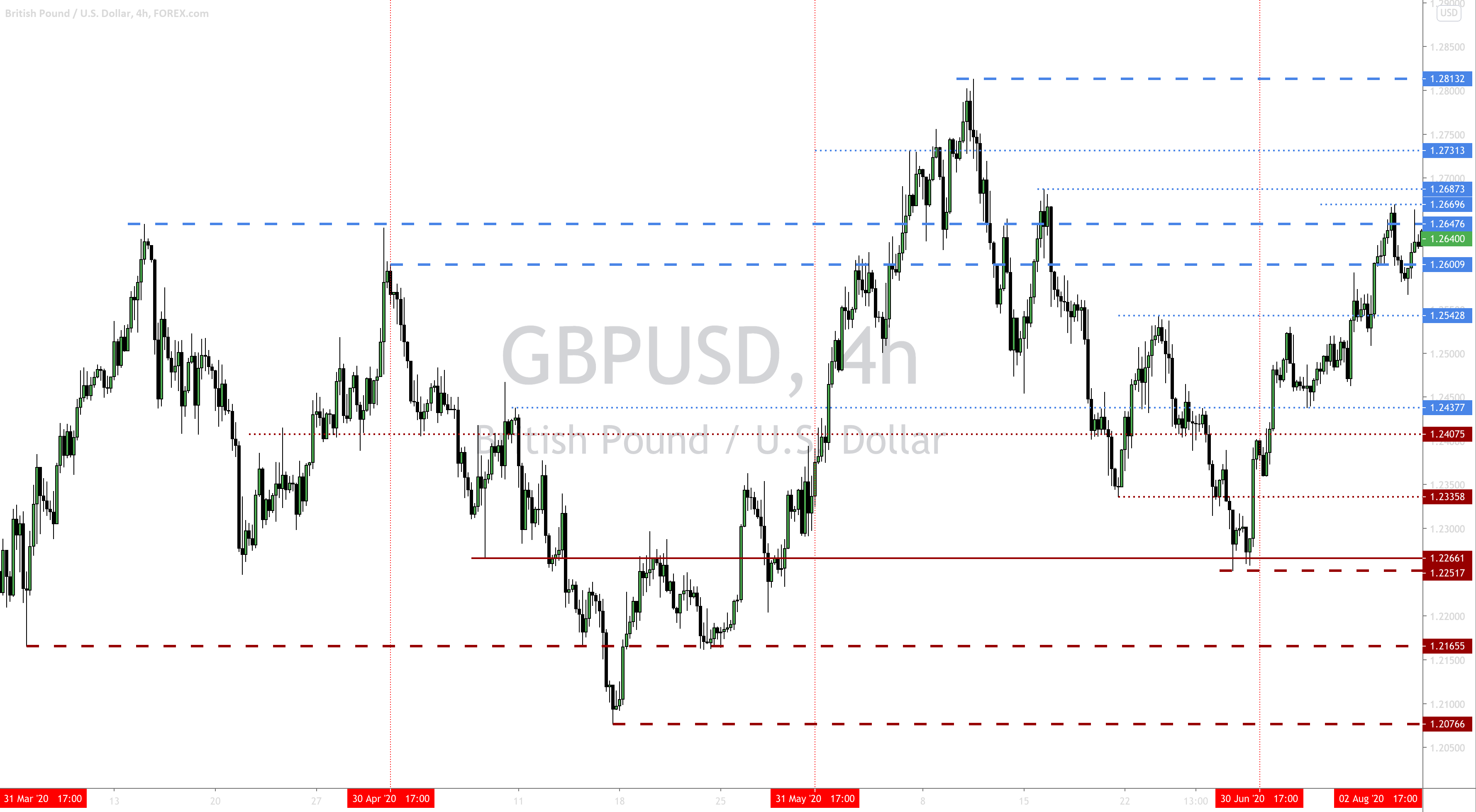

- We are going to find key levels defined by the weekly highs/lows and you can see how price sweeps below old monthly/weekly lows and then move gyrate to find other week]ly lows.

- 4 hour chart with the weekly and the monthly highs and lows marked out.

- We are using different colors to mark the highs and lows. (blue, high, red, low) as well as using different widths to differentiate between the monthly and the weekly points of interest

- when price breaks above the blue levels (old monthly/weekly highs), is the market going higher? or is it seeking liquidity and then rejection to go low?

- if it is taking out multiple blues, then that's indicating a bullish narrative and would appear to be seeking a higher liquidity pool, not a weekly high, but an higher monthly high, it's giving is an indication/xray of what the underlying market wants to do.

- the same applies to the opposite direction? multiple lows taken? seeking lower liquidity pools

- Daily Highs & Lows

- 60M chart

- you will see setups every day

- be content to take profit early on in the week (tues-thur). trades taken later in the week are riskier and are more likely to add to your losses at this stage of your development (maybe always?).

- daily highs and lows offer the potential for liquidity draws, meaning the market will likely go above our daily highs to reach the buy stops, or go below the daily low to reach the sell stops.

- Session Highs & Lows

- Notes:

- Look at this chart here, 60m time frame, lows where the arrow is

- Look at this chart here, 60m time frame, lows where the arrow is

- Monthly Highs & Lows

- key points

- breaking of old high/lows at key levels (old monthly/weekly/daily/session high/lows) to help determine the bias as described in this teaching

- time of day for NY OTE entry

- proper setup of price action from the london timezone

Part 3 - How Would I Practice

most important - for the NY OTE entry, need to declare the rules as they are defined in the OTE videos

- directional bias determination for the day/week

- where do we draw the fib from? which low, high? candle sticks or the body?

- definition of the TP targets - when to take profit?

- define the SL target

- trading view demo platform

- treat the demo account as real to build good habits - not overtrading, not overleveraging, using proper risk management

- back test by walking through the old data and look for the setups, then test the result

Part 4 - How Would I ...

- blah