ICT Youtube Community Messages

Select postings from the ICT Youtube Community Channel: https://www.youtube.com/c/InnerCircleTrader/community

Day One: Maximum Effort.

Today should begin your new journey...

A journey of self-discovery & empowerment. This is done with a powerful tool. The secret to effective learning & measuring that progress - is a Journal.

If you do not have a journal, go buy one today. Sometime, during today... sit down and record today's date on the first line.

Then in a brief paragraph record why you want to learn how to trade. Keep it brief.

Then list 12 things you want to achieve in 2021 as it relates to the markets and or trading.

Do not waste this opportunity... it will be crucial on December 31.

We are going to walk together, through 2021.

When you come out on the other side... you will be better than you are right now.

I promise. Just take my hand... I know my way around.

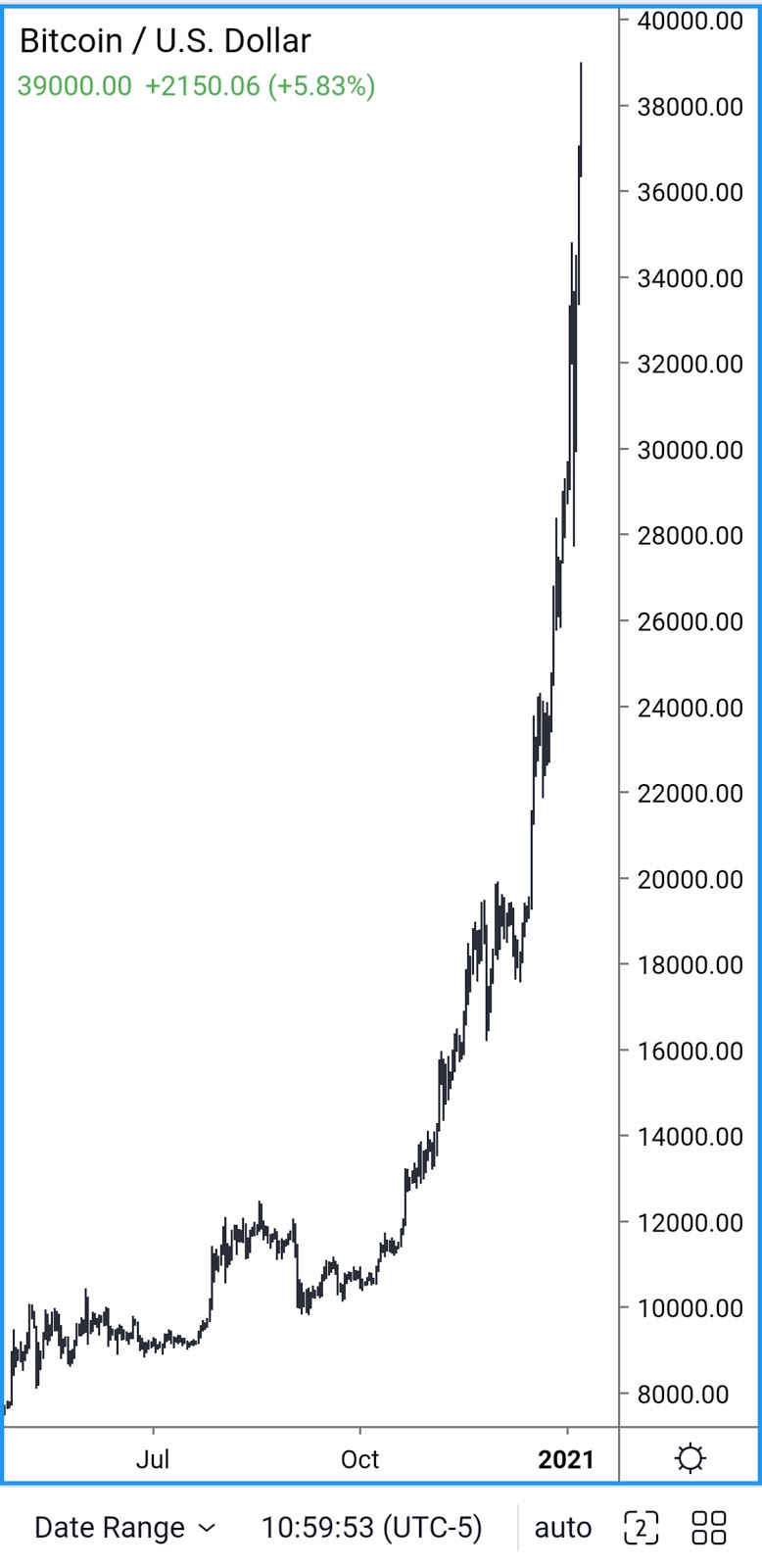

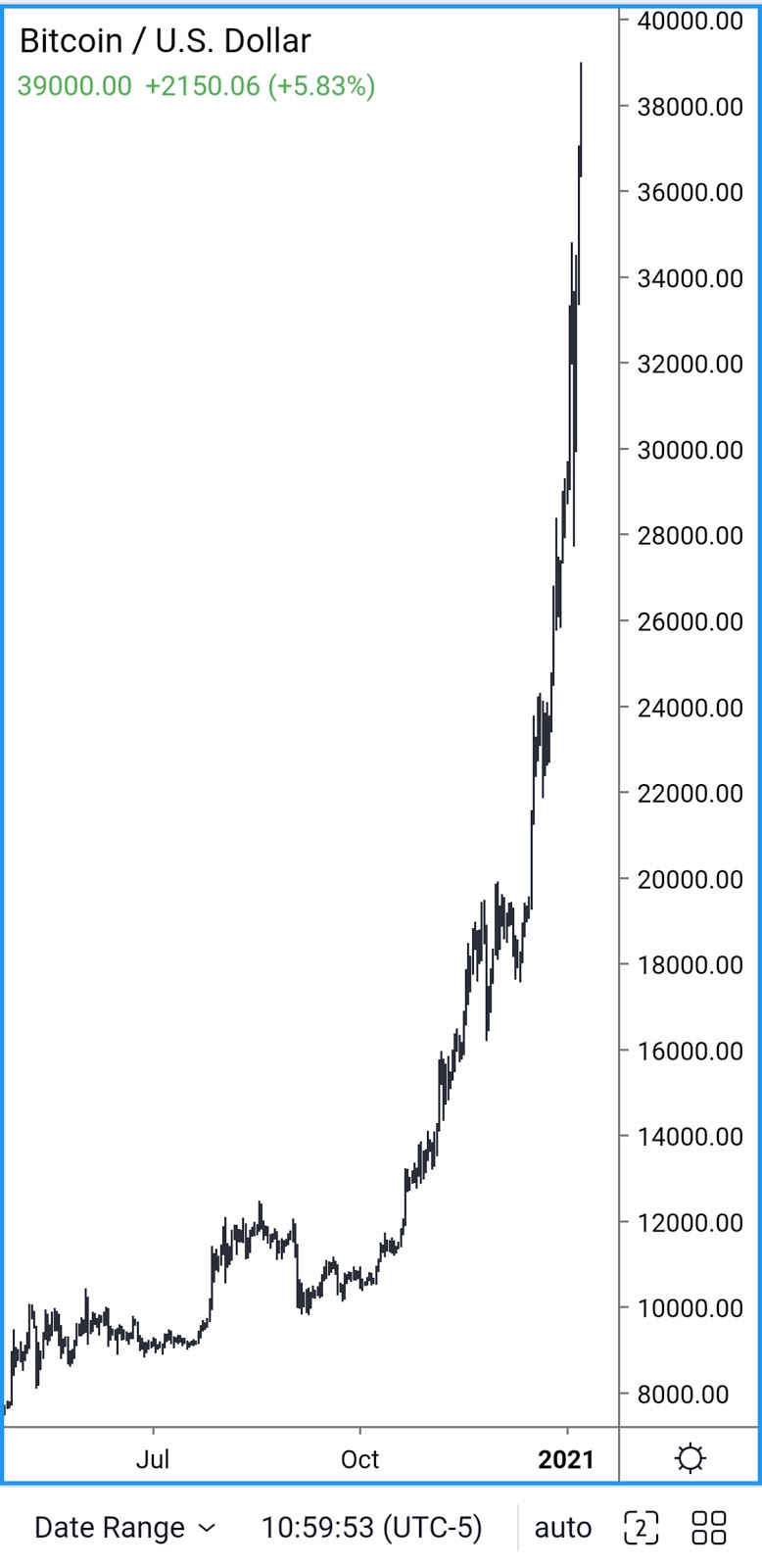

July 2020 I explained on Twitter that Bitcoin would trade to 30k by 2021. I was off by a day - I stated I would delete all my social media if it didn't. I had already deleted my Twitter and Instagram.

Crypto isn't my thing... but I suspect more people see the nonsense about me as just that. Baseless and envy.

Seeing is believing and 2021 won't be any different.

30k Bitcoin... cheers.

Day 2 -

Know where your insights come from and filter out misleading or fake education.

Limit your focus to that which is proven. Emotions are distracting... keep them out of the equation.

Keep your attention on the 12 things you set out to learn. I will multiple that list exponentially as the year pans out.

As you were...

Day 3 -

Are you confident that you are learning things that are real or contrived? You know by seeing. Not seeing examples illustrated but by studying the characteristics of it. Then searching for it on your own... in private analysis.

Do not rely on the hand of others to feed you... you will starve, if you do.

Only the strong survive here.

Stay hungry.

Day 4 -

Keep your charts organized and neat. Avoid extra distractions and only annotate what is salient to the present market conditions.

Keep your annotations positive and avoid negative remarks like "I am stupid for missing this..." or "why do I keep losing?"

Your subconscious records emotional stimuli that you associate to charts. In response, charts will create fear & anxiety.

This promotes analysis paralysis. When your annotations are positive it will be a constructive criticism that you will remember subconsciously and it won't be a hindrance to your development.

Day 5 - We do not play lottery with price charts. We focus on the low hanging fruit and in the proper context.

We do not force or gamble on a "what if" setup. It is a low resistance liquidity run or it isn't. There is no debate or confusion.

We hunt soon.

As you were...

Day 6 -

All eyes on US election theater. Expect shenanigans & flags. Nothing else matters today.

I am not here to make friends. I don't believe I will convince everyone because many are too lazy. They will not test what I say and teach here for free. It is easier to take the opinion of strangers on the internet than to do their own due diligence on the matter.

If I make money trading it is called fake. If I make money teaching, they call it my only means of income. They say my concepts are copies of retail garbage... but not one person can make the case for this. I will pay 100k to anyone who can... period. Make it 250k now.

If I am only living on Mentorship millions - pray tell, why am I turning off the million dollar money stream in 2022? You people are ridiculous that spout this kind of nonsense lol.

Screenshot this post. If I offer Mentorship in 2022, make videos, share it everywhere. It would be proof I can't feed myself without it... and I can't be trusted.

Fair enough?

Winter is coming...

Day 7 - Today is just one day of the rest of your journey. Yesterday's results do no limit you or define your destination.

Keep the focus on the process. Submit to the time required. It will come.

Meanwhile... Bitcoin 39k... remarkable.

Elon Musk passed Bezos 188 billion Net Worth.

Remember that TSLA buy in October 2019? It traveled a lot since then.

Bread and Butter pays the bills, mega trades pay for the lifestyle.

Gold is a manipulated market. I pick my times when trading that metal. It is an event specific market, in that, it requires some event. It is not so much a value market. It is many times, used to trap neophytes in moves that get hyped by advertisers and metal brokers.

I am neutral on it at the moment.

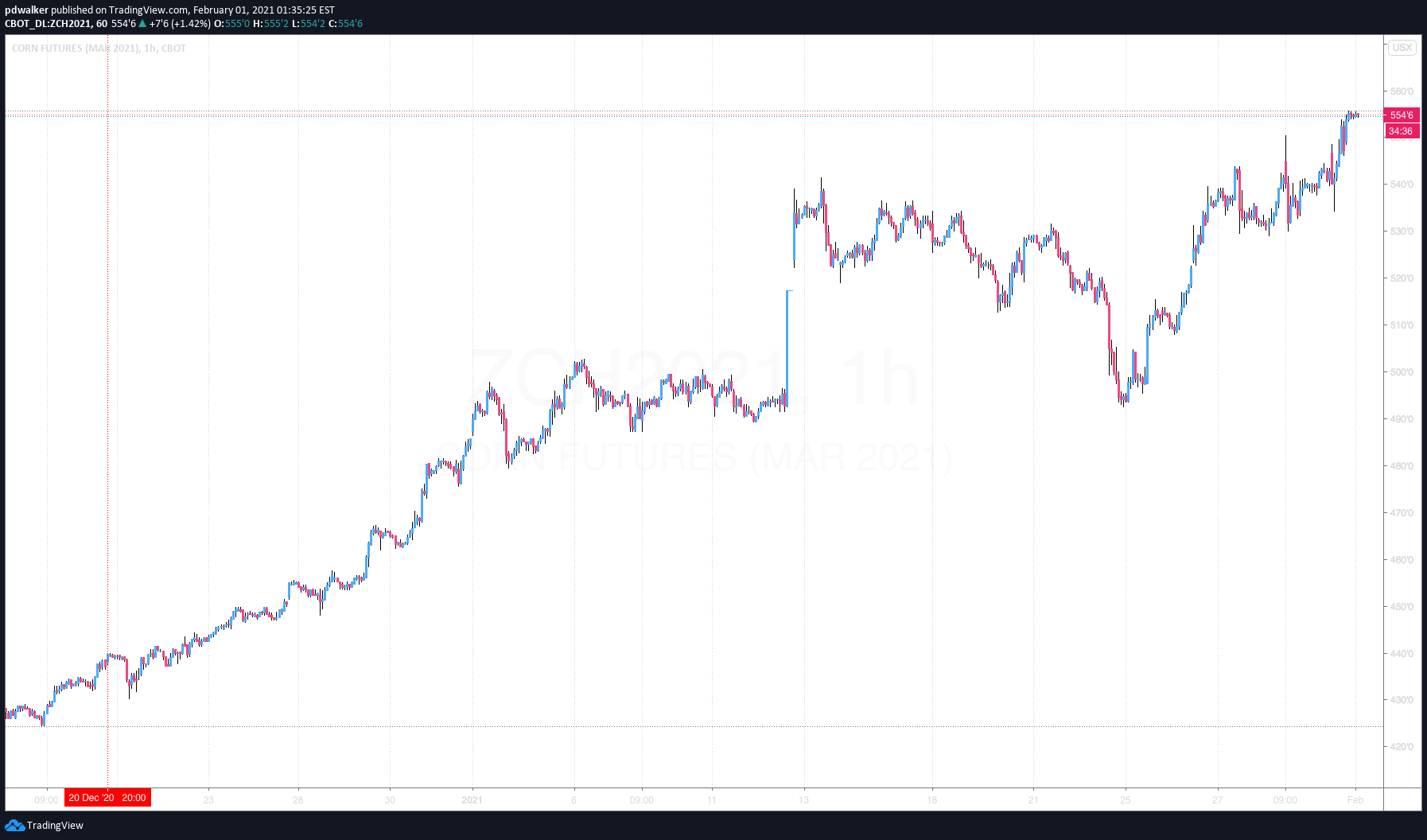

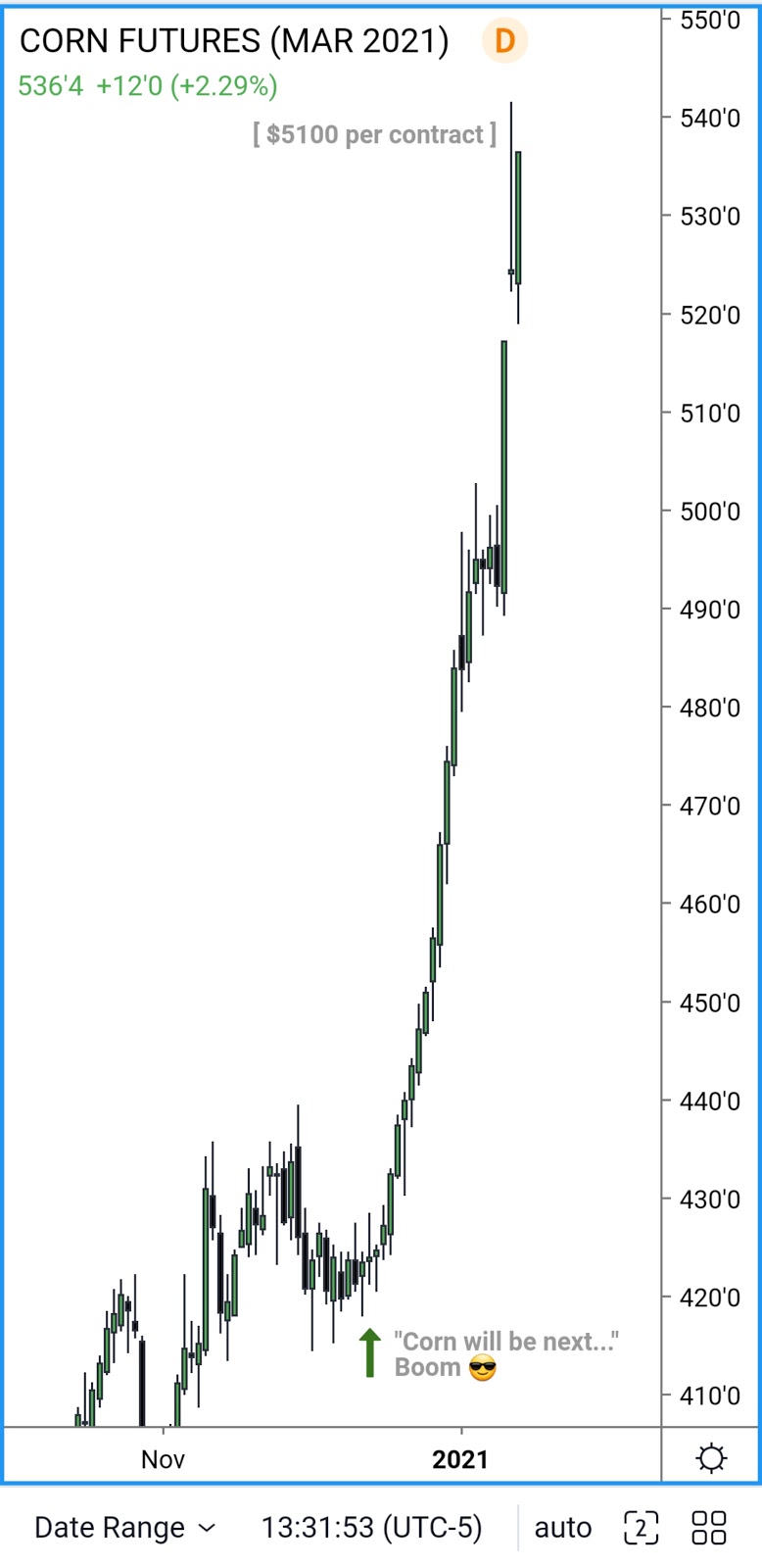

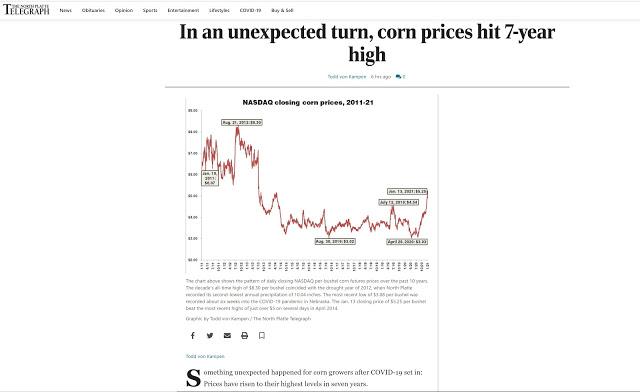

Do some research on Grain reports. Soybeans, as I stated since June of this year, is poised to continue to rally into 2021. Corn will be next. Why?

China is buying everything they can. Soybeans is used in many processed foods and are used as livestock feed. If Soybeans are low on supply - feed will switch to corn... then that grain will go into low supply.

Wheat will be a grain that sees higher prices in 2021. Food will be the fear and concern in 2021. Russia has made it known they will consider export tariffs on wheat.

Think food futures... that is the next "Bitcoin" mega trade.

As you were...

Go to Tradingview and enter ZCH2021 to see how Corn Futures responded on this call. December 19, 2020. That is a 3k per contract move. "Smart Money" is not limited to "one" market.

You don't like to scalp intraday? Day trading feels too fast for you? Short Term requires too much day to day analysis? Swing Trading might be your style. It is all relative... I have an approach in all disciplines... just match your personality to the method that best suits you.

Never let me, or any educator, force you into an analysis approach that does not fit your style and personality.

When you find what fits you... your emotions and trade psychology will not hinder your progress.

As you were...

Day 8 - New beginnings are both exciting and frightening. On one hand, you want to get started on the right foot and see results quickly; and at the same time, you don't want to make mistakes. I want to remind you to invite the mistakes early on. These are your opportunities to learn.

The pain and discomfort you are trying to avoid is the smoothing out of rough edges in your skillset. Do not try to avoid this... it is crucial to submit to it. There is no ego involved. There is no reason for you to fear doing something wrong. This is the natural result of feeling rushed to trade with live funds, when you are not ready.

Anyone that says you will learn how to trade consistently, profitably and free from the chains of fear and greed in any time less than 2 years, is lying to you and doing you a disservice... avoid them. Honestly.

If you disagree, come see me in less than 2 years with your millions.

18 days to go before the final ICT group begins their journey into the depths of my experience, concepts and cerebral cotton candy. I am excited for you... use this time to obtain a few notebooks. Get a good spreadsheet application like Excel. You will want to log lessons and details from them, so you can find them for your reference, as you go through the Mentorship core content.

I will outline how to do this when you begin, don't worry about it right now. Submit to the processes I give you and stick to them, and you will get here. Those of you that went through Core content, you will do well to follow my lead this time around. You missed a lot, in your haste.

Tomorrow closes the door for enrollment interest. I realize some are not going to meet this deadline for various reasons. To those who are in this circumstance, I understand and apologize. Please understand, like you and your life requirements, I have mine too. This Mentorship requires nearly all my conscious time and is very taxing. If you knew how much goes into managing it, you'd understand.

It is not personal, it is not cruelty or selfishness... I am in need of returning to my preMentorship life and pace. My hope is this does not turn you off to learning what you can here. I will do my best to share lectures on this channel when my time permits it in 2021, but I can not commit to anything with so much expected of me already.

When my commitments are serviced, I will return to a more frequent Youtube pace. If you respect me, you will grant me that. I believe I earned that much.

Besides, you have yet to master what is here for free... get busy.

Day 9 - The first full trading week of 2021 is in the books. It is important to note, every year, the initial weeks of January are slow. I do not mean that opportunities can not be found, but rather, big institutionally sponsored swings are not typically expected.

With the exception of Bitcoin, where all the attention and excitement has been... the markets appear to be delivering on their typical seasonal tendencies.

Retail traders are frothing at the mouth to get in new trades. Smart Money uses this month annually to study what sentiment and any macro influences are in play. If that is the norm, do likewise and wait.

Wait for what? New market structure insights after an initial displacement in price. It is important to hold end of year biases loosely, into the month of January. This permits flexibility in new year analysis.

Why is this important? Patience & sound logic.

I lost a lot of real money, in my early days, forcing a view into a new year. I was too busy looking for evidence I was right, instead of, reading what the market was actually telling me. Often, in those early years of my development; it was telling me that I was wrong, but I was hell bent on being "right"... so much so, I couldn't see it.

Be willing to be wrong... it is less painful and allows your analysis to be more fluid and by default... makes you better for having done so.

As you were...

Day 10 - While taking on the challenge of learning the fine art of effective analysis in Price Action, there are a few things to keep in mind.

There will be a lot of theory in the development stage of your learning. It will seem like an ever increasing amount of moving parts. This is much like watches.

If you want to wear a watch for the purpose of telling time, just about any watch will do. If you want Swiss Craftsmanship - this suggests that you care more about precision and quality... in telling time.

To appreciate the precision of a fine Swiss Timepiece - you study the intricate placement of every small component. The artistry and masterful design of every facet inside the watch.

Do you need a Patek Philippe to know what time it is? No. When you find the appreciation for telling time with class & precision... you choose Swiss Craftsmanship and it comes with a price.

The price in knowing precision in Price Action is lots of theory and appreciation for the details. These are found in "boring, dry lectures". It only feels boring because you want the action points... the triggers... the signals.

However, you need to understand how to anticipate the effects of many circumstances in the markets, before you can reasonably expect to have consistency in your skillset.

This requires dedication & submission. Time is the currency required. If you bring a Casio level time investment to the table but want Rolex results - you will be disappointed.

Precision is not required to profit. Sloppy analysis, poor executions on entries and exits; can still result in profits. How you endure these transactions of "time", is the difference between Casio level and Patek level precision.

Do you feel anxiety or impatience in your setups or is it just another transaction you participate in? One that you studied intimately and understand the details or "craftmanship" in its logic and delivery?

Or are you just looking for a "time" to push enter and hope it pans out for you?

There is a difference and it is not founded on randomness or luck.

Choose precision and experience artistry in analysis. You won't regret the effort and time invested, to acquire it. Then onlookers will appreciate the craftmanship of your skill, like that Patek receives and Casio won't be given a second glance.

As you were...

Day 11 - It still works... and handsomely, I might add. Do not fear the uncertainty of the present. Wealthy people have wealthy tools that they will protect to keep them wealthy.

Markets may see sudden adverse moves but these are opportunitites... not dismantling of the tool.

Keep emotions out of it. Keep risk low.

As you were...

Day 12 - When a student endeavors to learn how to read Price, it begins with a Macro Perspective. This is not merely a Higher Time Frame Analysis but rather Seasonal.

How a market tends to deliver during a specific time of year, is beneficial to the fledgling student. While Seasonal influences are a powerful tool in analysis, they are not a panacea.

Although, Seasonals are not a "be all end all" silver bullet for Price Analysis - they do provide a general roadmap in many ways. However, in periods when a market tends to seasonally perform one direction but shows a divergence from the seasonal... this can hint at a stronger counter seasonal price event.

A departure from the norm, in Price Action, tends to incite excitment in Price and opportunities. Far more importance should be placed on this area of your study, than that of entry patterns.

It matters far less "when" you enter, if you have the underlying basis for a directional price run incorrect. This feels counterintuitive to the new student. They want to be a sniper and pop shots like an elitist technician. However, they don't consider the effects of seasonals on their "money shot".

The secret to precision placement on your entries and low drawdown is rooted in being on side; being dialed in on your market. You get there by knowing the Macro phase first. Then reducing all your tools and navigation in lower timeframes with that premise.

If the perspective is unchallenged or in essence "onesided"', you have optimal conditions... squeeze the trigger. When you don't, wait for a cleaner shot.

As you were...

Day 14 - Two Weeks into the new year, how are you doing with organization? Are you finding it difficult to stay focused on the task of journaling?

If this is you, keep doing it. New habits take time to develop and then results will be measurable. Comparing your progress to when you were not trying... is a bit premature.

It is much like doing squats your first few times. It is painful and walking stairs becomes next to impossible. It is easy to think, why am I putting myself through this? Is this pain worth it? Yes, yes it is. Suck it up.

The things you are doing are going to elevate your ability to decypher Price. You have to adhere to processes early on, that will feel like dry and boring routines.

These practices of logging observations in charts and marking up hindsight fractals, annotations of your remarks that are based on your level of understanding... all of it is crucial.

Without this process, you will not have a measuring stick or baseline to evaluate your development. You want to have data, visual aids, actual evidence that your skill is indeed improving.

Like squats, it only hurts initially, but months from now... you will see the results; that only feel like agony and pain inside early on. Keep pushing through.

Over time, you will come to enjoy journaling Price and observations. This is the stage right before you start to see things before they unfold in Price. Then you will be an addict.

You will not doubt yourself at that stage, you will laugh at naysayers that doubt you or your pursuit. It will become clear that those who try to detract and distract you from your goals... are a waste of attention.

This will further increase your drive and focus... in solitude. Early on, your weakness and uncertainty will crave companionship. You will seek to be part of a tribe or pack and have a hive mentality. Avoid this... learn to walk alone.

None of these chat rooms will actually aid you. It is like holding hands with an abuser. It is holding the problem and hoping it changes for the better and that you might benefit... but it never comes.

Study alone, this develops confidence in yourself. You can do this, if you listen to me. You are all that is required. No one will push the trade execution for you, no one will enter your stop loss, no one will close your trades for you.

So why are you inviting the illusion that people who know nothing about you or how to trade... will have a positive impact on your development? This is codependency and it is poison in trading. Stand alone. Collect the glory solo and share it with no one.

It is you that busts your ass to learn this. It is you that grinds through, despite it being hard and long before results can be seen. You are the one who gets down to work with studying and doing what is necessary to succeed.

Everyone else will be making excuses why they failed. Everyone else will be huddled up in chat rooms with an open outstretched hand, begging in silence for a crumb. They will starve, while you feast on opportunity.

Do not feel compassion for them, they know what they are doing is not the way. They want an easy walk, a free ride to profitable living and it never comes that way. It is earned with pain and sacrifice - by doing without all the distractions.

Only the strong survive here. Only the strong get it. The weak will talk nonsense, when it is too hard for them to stay on task and learn it. You are not weak, you are not entertaining fools. You have a vision of your life and you found your path to reach it.

Stay focused on you. Everyone must fend for themselves. You eat by your own hands... you gather experience independently and this is a resource that is intimate and can not be shared or deposited into another. You, like everyone else, must bust their ass for it. Now get back to work.

As you were...

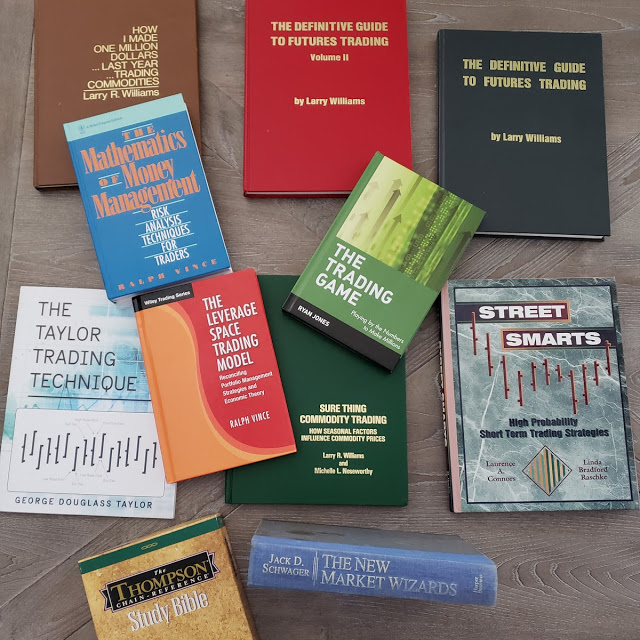

Making Money Moves With ICT...

Click the image to maximize.

Day 15 - Change is coming... ready or not. Make yourself ready. Give yourself every advantage possible and purge every waste of time and money.

Enjoy this weekend. Enjoy family. Rest.

Next week may be eventful for all of us.

What is a realistic goal for new Traders, that have discovered their unique model?

2 to 3% a month, at first.

When this becomes consistent, you aim for 4 to 6%.

Gradually increasing over time... not rushing to make double digit percentage per month.

Submit to time and experience will empower you to do well. You think this is slow and holds you back. It doesn't. It prepares you for the exponential effects of compounding.

Compound interest is amazing and while it can be a fast elevation in equity, so can the downside be... on the opposite extreme.

The time you think you wasted by going slow, will be made up for quickly; if you do it correctly. Rushing will only guarantee you get further behind and less net profitable.

Just ask every Trader that rushed to live funds. It is the same story... same outcome. Those that are consistently profitable are the ones who went at a gradual pace.

Do you think they care who thinks they did it wrong? The opinions of many, who aren't profitable, are useless. Follow the advice of those who do, can and will in the future.

Instagram is not wealth instruction. It is fraud and deception and luring the unlearned into traps that neither their pockets can afford or their psyche.

As you were...

I can afford to wait for real ones.

If you get insights from a YouTuber, you should give them a thumbs up. It is free, it took them time and energy to produce it. It takes you nothing to click it.

Too many entitlement minded people are selfish and ignorant to merely consume and give no thanks. I demand it now. It is not a bribe as losers would state.

I don't care if I ever produce another YouTube video - but I will when my recent video shows 7500 thumbs up. This grows the channel and you give appreciation for my time.

I wasted thousands of hours of my life on undeserving viewers. Interactive participation controls my pace of how fast we get to the next video upload on here.

I don't do things traditionally. Why? I am already here. I take chances with my image and do things that others would never do, because they aren't in a position to do so. Everyone else has to post daily to eat... they depend on ad revenue. I don't.

Who walks away from easy millions? Who says they won't do until the audience shows support for the time in effort? Who calls the major moves and publicly... for free? Just me baby... just ICT.

Give and take. There is an exchange expected. Don't be sour, participate... and be patient.

My time is worth something. Don't complain if you are asked to do the least in exchange for it.

Day 16 - One year ago, I told you to prepare. I also told you to prepare four & a half years ago... for this coming week.

Some laughed, called me chicken little, mocked me... but take a hard look around. Still laughing?

You are going to need to think differently, earn differently, prepare your home for disruptions. Food, meds, day to day staples and water. Top your car fuel tanks today.

Visit an ATM machine and get some cash on hand, in the event service issues arise and paying by card is not an option.

Peace of mind comes from preparedness and no fear is being pushed by me. If nothing happens, you were at ease and prepared. If something does, and it sure looks dressed up, you will have preps to make it less stressful.

So many things converging this week, it would be foolish to disregard the level of absurdity we see in America right now. Be prepared as best you can and occupy your mind with positive engagement.

Many took my advice last year and this entire thing was less impactful for them and their families. You have a few days still... make good use of them.

No fear.

As you were...

Day 17 - You might not believe in time travel, but when you submit to the process, it will appear it exists. At least to those onlookers, that watch you operate. What do I mean?

Sound Price Analysis will present a perspective that evades 90% of Traders. When you understand what you are doing, you will have forecasting skills that will impress those that do not know your craft.

If you show me the charts, I will tell you the news headlines... before they print. "Unexpected", they say... that is cute.

As you were...

Day 18 - As the world waits on pins and needles for Wednesday, today is a Bank Holiday in the US. Respect the risk, this week presents.

_________________

[January 18, 2021 08:35 am EST]Day 19 - Use these next 48 hours as a study in liquidity. No one knows what will happen during this period and how the CB will use it in delivery.

This includes ICT.

Be safe.

_________________

[January 19, 2021 8:18 am EST]I get asked a lot about sleep... and sleep schedules. I usually do two four hour sets of sleep and if I find time, a cat nap between.

Whatever works for you, that is all I can say. My schedule is dictated by the work load while running this Mentorship at full pace.

After this year, it will allow me a more routine sleep and life cycle.

Everyone has hurdles with jobs, family and hobbies. There is no secret recipe for everyone... you just plan it best you can and work with that. Pick your trade session and frame it all on that.

_________________

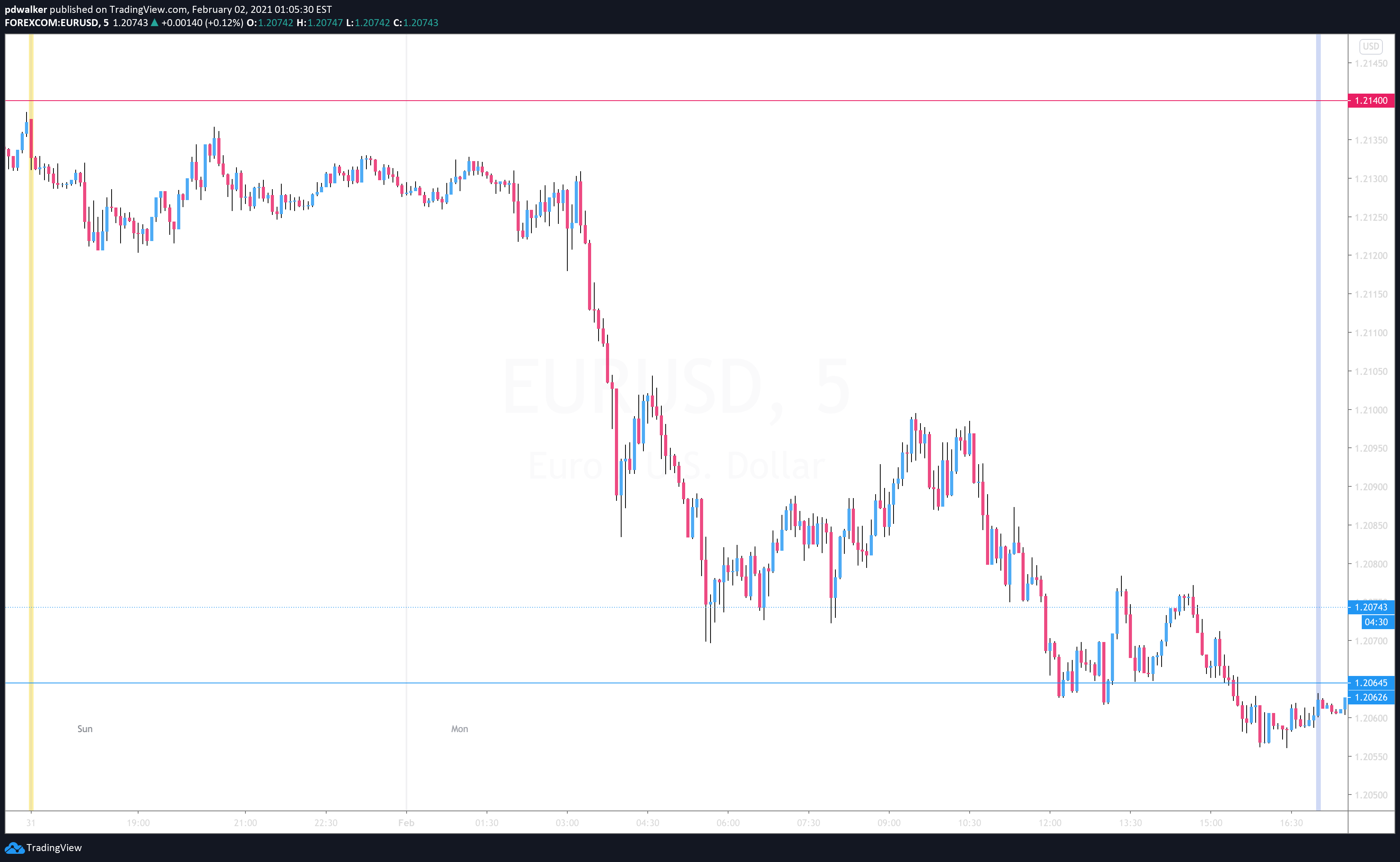

January 19, 2021 1:20 pm ESTJust looked at EurUsd... I might have been off on my view. It only went down to 1.2053 and failed to print 1.2050. Well over a penny move, nonetheless.

See, I can get it wrong... sometimes. Taking partials removes that stumbling block for you along the way... and pays you when you are "wrong".

How is that for sound logic?

#Perspective

_________________

January 19, 2021 1:28pm EST

Edited for correct date. It isn't 21st for you yet.I am trying to provide date and timestamps for these posts and I just realized I put the 21st of January on the post under this one... I corrected that date and sandwiched in between this one for timeline purposes.

Youtube should add time and date stamps on these...

_________________

January 19, 2021 01:33 pm ESTDay 20 - Stay still. Observe. Be safe.

_________________

January 20, 2021 0815 am ESTDay 21 - Be patient and learn to wait for your model, your setup to form. There will be many price moves that unfold that you will not participate in.

Obsession over being in every movement is a characteristic of a neophyte and you will grow out of this stage, over time.

Keep your focus on your unique model, setup and framework. Time and adherence to that will deliver you where you want to be in analysis.

As you were...

_________________

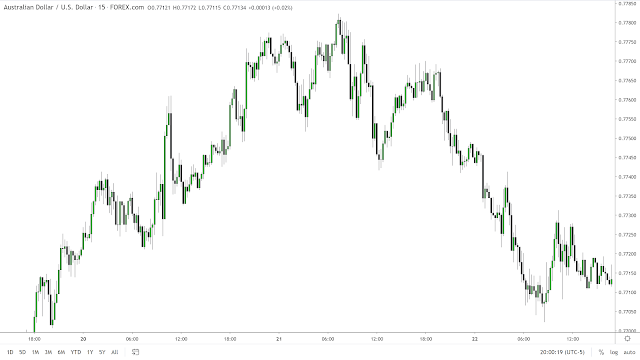

January 21, 2021 08:45 am ESTGbpUsd continues to punish the sellers. Deeper run delivered as I thought. Tricky pair, only the nimble.

Bitcoin looks like it wants to wash out 27k... buckle up. Might be painful.

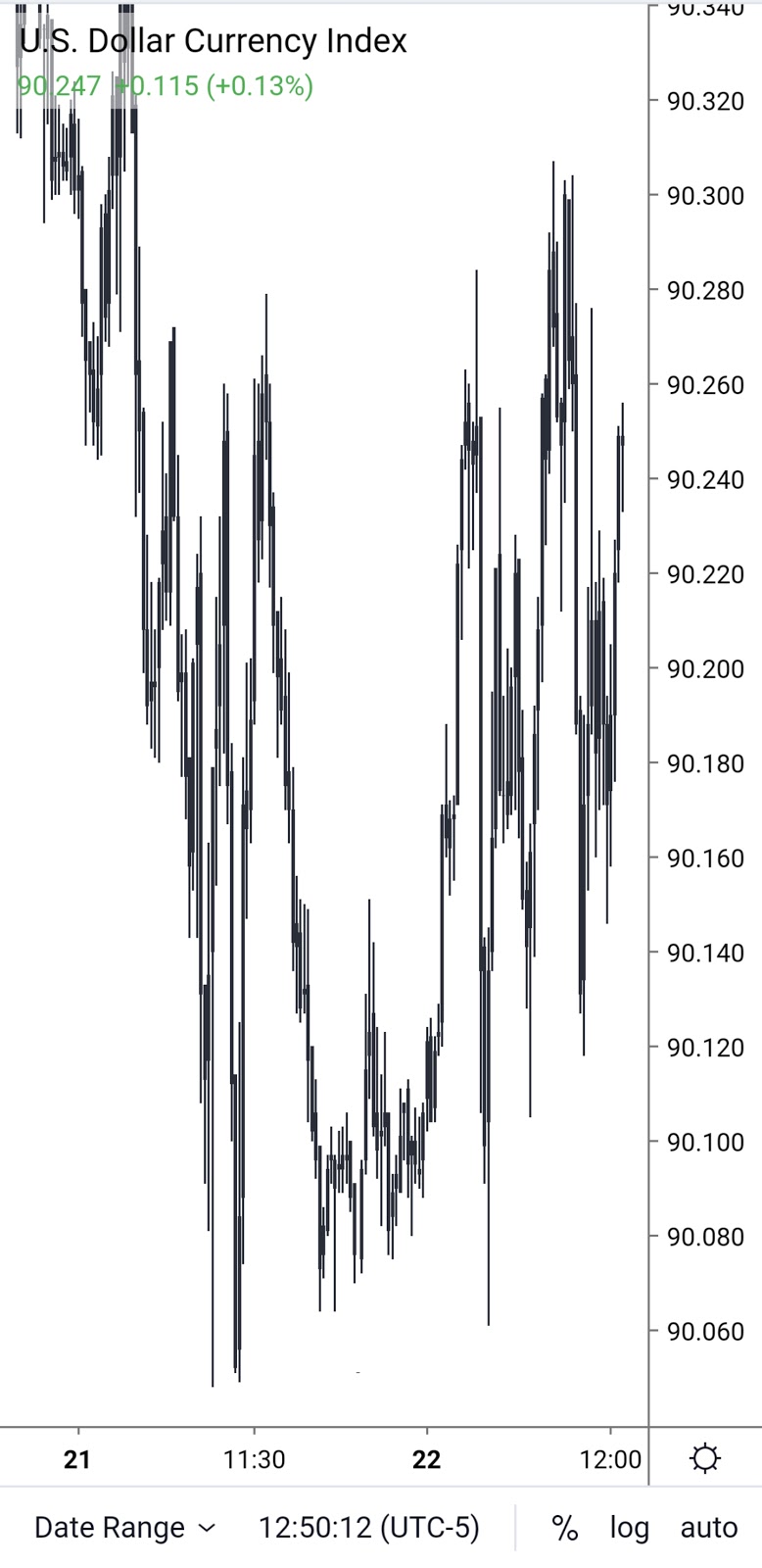

Dollar is not where I need it to be, so I wait... longer.

We will hunt soon... stay hungry.

_________________

January 21, 2021 09:47 ESTWhen you sit down to analyze a market, start with the Macro Market conditions.

It is not wise to begin your search for entries - before you first determine if the market is primed to move, in the first place.

Many fail on this stage of development and in live trading. They will pretend to know it all in comment sections & chat rooms but they secretly fail in trading.

These are the same that are the most impatient for my next video to drop. They love to hate me... and never learn how to trade because of it.

What a terrible waste of time. I can't fix everyone.

_________________

January 21, 2021 02:00 pm ESTDay 22 - Choices... make them carefully. Test your ability to make them here.

Listen to: The Illusion Of Choice

https://soundcloud.app.goo.gl/34mPyDo you really listen?

[Paul's notes: Do it!]

__________________

January 22, 2021 12:14 pm ESTEverything is scripted. It appears you have control, that you have free will... a free choice. Many are unsettled once they discover how much is scripted. You can become angry, outraged at the deception - or use it. Yes... use it.

What many will get tripped up and snared in, you will find as opportunity. Does the Wolf apologize to prey beneath it? It is simply being the Wolf... it is neither evil, nor tragic.

You need to eat. So eat with a clear conscience.

As you were...

_______________________

January 22, 2021 12:42 pm ESTKnowing why and when it will consolidate, makes a considerable difference in your bottomline...

Being initiated has its privileges.

_________________

January 22, 2021 12:52 pm ESTDay 23 - I was never a "Q" believer. My students know this is a fact, I was very critical of it. My post yesterday, was a reference to Day 2 of a new administration that will not be favorable to many things economic. As such, things will deteriorate and many will deny it... until it speeds up.

I didn't vote in 2016 or 2020. I am objective. I had no team or horse in the race. I am not drunk on new power, nor am I heartbroken over biden. I am indifferent - but objective. My view is not tainted with mascots and stimulus hopes. I don't pretend to be a prophet, a fortune teller or clairvoyant... just a prepared individual with means.

Stop trying to make me out to be something I am not... I am killing this myth here and now. Change was instituted on the 20th. Some of you are in your glory, some of you are confused and upset. Many expected mass arrests... and they did occur. The arrests of those who destroyed the Capital building.

I give you my thoughts and expectations, I state plainly it is not to incite fear but to inspire you to consider preps... just in case things get tougher to get. I never said people should expect Qanon stuff... so stop spreading these lies.

Here is what I expect:

Unless the covid narrative evaporates by the claims massive vaccinations were distributed, which none of us will know is true or not... things will get harder economically. Period.

Am I taking any vaccine... no. My youngest son was harmed by a vaccine... save your opinions, we lived it.

Do I believe we had a fair process... no. Can I do anything about it... no. Am I going to pout for 4 years, nope. If things get better, I can trade in that. If things get worse... I can trade in that... in fact there would be monster moves in commodities. I expect this... and if I am wrong, I lose nothing.

There are some who twist my posts because they do not have the backstory or details I laid down for my students directly... over previous months of commentaries. None of you, who think I am a Qanon supporter get it... I stated this was a psyop the entire time.

The uncle I was exposed to trading with was a hardcore Q fan and is distraught over all this now... and I tried to prepare him for the inevitable - but I could not reach him. It became too deep in their minds as it had to be real... when it was used to make those who would do something - sit still and allow it to pan out... uninterrupted. Take a step back and you will see it clearly now.

Do I believe harris will take the seat, yes. Do I have high expectations for economic improvement - no. Do I believe both sides are tainted... yes. They are two wings of the same bird... and they keep us divided. I hold Republican views by majority and always felt this way. I felt some of Bill Clinton's work... some... was good for the economy. I believe Reagan was our last real President... the rest have been selected. I don't care to know your opinion... so save it. I won't entertain it in emails.

When I tell you I am preparing for disruptions in supply, I am communicating in no uncertain terms that maybe you might consider it. Am I trying to scare you... no, obviously not. I believe food will be weaponized eventually and fear will cause the weak to hoard and loot and your ability to obtain these things will have passed.

Some of you try to send me emails and say... "you were wrong, nothing happened". I am not preparing for a single day... I am prepared for a year. If something does happen, my family is prepped and I don't have added stress and we don't need to venture out if things deteriorate. If nothing happens, I have things I use anyways and I won't need to buy it for months. Who is laughing here... really?

It is better to have and not need, than to need and pray to obtain it... but can't. Think. Don't be so foolish to fall for this dog and pony show and feel like there is no reason to be concerned... there is and for some... it will be a painful realization, too late.

Make your house ready, as best you can. Not through fear... but for peace of mind.

Now you got it straight from me. There is no room for conjectures or secret messages... no way to make me a Qanon or trumper or biden hugger. They are all the same actors in the same theater - you just think you have a choice every 4 years... and you don't. Like it or not... that is the life we live now.

Feel free to unsubscribe if my honesty and straightforwardness offends you. I speak like this because I expect my audience to be adults that are reasonably capable of sorting out BS.

Make ready your house... period.

As you were...

_________________________

January 23, 2021 08:42 ESTSome of you might be thinking, "ICT is trying to scare me... I will not be bothered. It won't happen, I won't waste my money preparing in case any of it happens... I will just trade and be happy."

Imagine for a moment... as best you can imagine... the grocery is empty and your pantry is too...

There will trades and setups, yes. However, will you have the clarity to engage it, ride it out and execute with clarity and an empty stomach? If your family is stressed because you have lack... will you honestly be in a position to trade without emotion?

I have a million dollars that says you will be on the other side of my trades then... because you will be starving and in panic. The worse position to trade from... needing to make money and scared money doesn't make money... it is taken. It will be taken by people like me. You can hate me for it, or thank me for nudging you now... to avoid it.

Or do nothing. That is always an option.

Choose wisely.

Winter has come.

_____________________

January 23, 2021 08:58 ESTMindset is the battlefield we wage war on... long before the charts are ever considered.

Many of you are choosing to be ill-prepared for the war of profitable trading.

Don't think like retail.

Don't be the prey.

Be safe.

____________________

January 23, 2021 09:03 ESTAs a final thought... and to avoid needing to add it to Mentorship commentary...

What do I gain for warning you?

These posts are not monetized.

My Mentorship is closed to new enrollment inquiries.

Where is the pitch? Where is the pay off for me?

A clean conscience - nothing more.

I spoke my stance and I need not do it again. If you see others talking nonsense, share the screenshots from here. I don't have the time to debate ignorance.

This life will not give you many chances to get it right. If you have time and means to give yourself more advantages... do it. To not do so... in my mind, is foolish.

I can admit I would not be able to trade objectively in hunger and in lack with children and a stressed Wife. So don't pretend you will be able to when you haven't found profitability yet.

Swallow... that is good medicine... like it or not.

Rant is over.

_________________

January 23, 2021 09:16 ESTStudy the naked chart first, then when you are finished searching what you can find in the fractal... click the link below after, for the annotations:

spoiler below - hold until you are ready to view

https://www.tradingview.com/x/IMhDKIA5

Missed those didn't ya?

_______________________________

January 23, 2021 08:07 pm ESTIf you thought those 2016 lessons were all there is or they taught it all... man did you play yourself.

Good Times ahead...

After this year, Charter Members will start seeing opportunities daily... and a depth of knowledge they didn't imagine was possible.

Ready up... we go deep now in 2021.

Wednesday... the rest of you start that same journey. It will be long, it will be hard... but it will be so damn worth it!

I am so excited!

_________________

January 24, 2021 11:45 am ESTDay 25 - Measure progress on an intermediate scale and not day by day. It can be discouraging to look at the scale when on a diet and each day the change being so little or not at all.

You are learning how to navigate the most treacherous financial waters, during the roughest storms we ever seen, economically.

Did you expect smooth sailing the entire journey? There will be rogue waves, strong head winds that will make it feel like it will never let you get here.

Endure. The temporary adversities are just that... temporary.

There will be periods of smooth sailing and the journey will feel effortless. Then, there will be times that will feel like you are about to sink into Davy Jones Locker... and join the ranks of many would be mariner.

Keep your eyes on the horizon, it is where you are aiming for. The time to get here is unknown to you, this gives you uncertainty and perhaps fear. Acknowledge it but do not feed it with worry. Do the things you are trained to do, avoid those things that you ought not do... and you will arrive.

Remember, the navy sends their ships out to sea in major storms... for safety. The shore is were the damage is taken... at sea it is just a rough ride. Don't try to stay docked at shore... be comfortable in the storms. Be content with the direction and bearings you are following.

Do not lose sight of your destination. The journey wasn't promised to you in a day. Don't measure the distance each day, at the start of your journey and lose hope. Many turn back and head to the shore.

You know what waits for you back at the shore... the same wants and dreams. They won't sail in to you... you only get to that port of call by enduring the journey at sea... come what may.

Keep your hand on the wheel and yourself at the helm... eyes to horizon. Keep pressing forward.

As you were...

_________________

January 25, 2021 06:20 am ESTHave you ever noticed how these same candles - regardless of duration or timeframe - can feel like eternity?

A 5 minute candle can feel like an hour and an hour candle can feel like a day? Ever felt that?

It is rooted in your infancy as an Analyst, who rushed to being a Trader.

You have yet to submit to time, and that is achieved with months of training - not a weekend.

Time is going to pass in the same speed for you, regardless, if it is in pain or pleasure. Be indifferent to it, submit to it... but in doing so... you follow what I teach.

Over time, you learn to wait for the delivery. This is a hard thing to explain to a new student. The words might seem simple enough, but the process isn't.

Once you have submitted to it... progress is seen in the process. Submission to time is not weakness... it is where experience is derived. Experience guides you and you lean on this in periods of drawdown and confusion.

That candle is no longer in duration than the previous candle. You are merely trying to rush it to expansion to your target... is this submission to time? Or is it imposing your will on the candle?

The market will have no respect for our will. We must align with it and its algorithm.

This is the way.

_________________

January 25, 2021 07:00 am ESTI took nothing from Chris Lori. Stop the nonsense.

Paid members of his courses will confirm I am on another level. No disrespect intended... Chris never bashed me.

You read others that sockpuppet themselves and claim to teach my very own concepts better... but they do not.

What feels like "straight to the point" is just rushing to further ignorance. I challenge any of the guys who pretend to know my works to put up in February. All calls public and recorded in public domain... yes public before the fact.

Not one of these guys will bite... because they reside in the hindsight where they can "find" things to talk about. Not act on in precision trading... not precision talk.

Any takers?

I spent this morning trying to decipher what the CB's felt was salient about ECB speaker's speech.

Some of you think my posts are cryptic but her story about mice is oddly reminiscent of coded speech. I'm not a fan of cats.

If you see EurUsd, it was repriced on the release of her speech. Not a half penny reprice, but it was sudden and onesided.

It is only Monday and NYO... things still have time to develop.

_________________

January 25, 2021 08:10 am ESTTwo things that I do not know:

1) Where Sunday's Open will be. Nobody knows or ever will.

2) The exact weekly closing Price.

I do know how to find a lot between those two prices though.

The table of contents and appendix are the least interesting of every book... it is the story in between them, that tells the tale.

As you were...

_________________

January 25, 2021 08:20 am ESTScroll down [pdw: up!] and study the AudUsd illustration again...

https://www.tradingview.com/x/JDs6Tb6V

_________________

January 25, 2021 08:58 pm EST25 Pips a week Folks... that is where you start and build consistency.

Then you grow from there.

Get busy studying.

_________________

January 25, 2021 10:37 pm ESTDay 26 - Many of you are learning why I do not choose to trade in the month of January. While it might be true, that the smaller timeframes are moving; the macro timeframes are not. As such, it creates far less probabilities to trade, and I do not like to gamble. I like sure things, and in Price Action, there are signatures that get really close to that. We are not seeing those signatures yet, for 2021.

At first glance, to a newbie, it feels "broken" or perhaps the idea that "they" changed the algorithm. This is not the case, nor should you be concerned about that. This is typical January quagmire, that generally does not move very much.

Why is this? Well, typically the world's money is parked at the first of the year and they wait for the new trend or the old trend to resume. It comes, generally, with an animated Price move... that inspires greed. Then the Central Banks will use this new sentiment for the next 2-3 months.

As a child of the 1970's, yes I am kind of old huh, we played Atari. It was nothing compared to the games of today, where you can free-roam and first-person perspective can be cinematic. In the old days, we played a game named Pong... where it was two rectangles that could only move up or down along the left and right side of the screen.

The goal was to have that rectangle in the correct place where the small block would "hit it" and send it to the other side of the screen. Ping Pong essentially was the idea with this simple and yes very boring Atari game. You did not get to explore new worlds, new maps, new levels and new adversaries. No, you were kept in a small box and only had a small block to entertain you or bore the heck out of you!

This is much like trading in January, every year, to me. It is like that vintage Atari game Pong. Yes, there is movement, but it isn't terribly exciting... yet. Which is why I make it clear that I refrain from holding hard opinions or ideas about the markets in this month. It is also the reason I defer new enrollments until the last week of January... so they are not immediately met with boredom and noneventful market commentary.

Each year, you will discover a repeating theme to specific times to the year. Like a Daily range, the Yearly range has its dead times. Like my Central Bank Dealers Range concept highlights the slow periods intraday... the month of January acts just like it. We use the quiet times to frame the animation later in Price. The same is said for the month of January... we allow the banks to set the initial parameters and then wait for the displacement in Price.

Neophyte educators will cheerlead these minor fluctuations and their patter will fool onlookers. Trust me in this, there is no real money in motion yet. Small fluctuations can pay, and you see me do a lot of that kind of trading in the past. I do my analysis with the next several months potential movement in mind. I want large order flow behind my trades, not a gamble on a 1-minute chart for volatility sake alone. This is gambling... this is not what I trade, and I do not teach like this.

Too many use my logo to draw in a crowd and pretend to trade like me, but it is not anything like me. Fraud and impersonation are rampant these days and it is a shame. Many will fall victim to "so called ex-students or banned ICT student" con jobs that only serve to line their pockets on my name and not on their ability to trade... or teach properly.

One of the best testimonies, to skill and experience, is the Mentor understands when and how they will be wrong. What scenarios, or periods of the year, where they will not do their best, or perform at their optimal levels. They do not try to pretend to always know it all. I make these periods known to my students because they repeat annually.

These are the periods where I blew out accounts. Where I felt like quitting and endured the most frustrations. Is it any surprise that everyone else will suffer in these same periods? No, but you never consider it because everyone is believing the lies and fake imagery of this industry.

If you can know, in advance, where and when you will likely do harm to yourself... isn't this beneficial? Isn't this valuable information that you can use to avoid needless losses and frustration? I wish I had this perspective and insight in 1992... but I had to pay for it with fortunes and mental illness. You get to benefit from it with next to no cost or exposure to pain... and this fools you into thinking it is of no concern or value... when it is worth more than precision entries.

This logic flies in the face of Instagram personalities that want you to believe they got it all together... and know how to be always consistently profitable. This is a farce and the best of the best know their limitations... and on social media, gurus seem to have no kryptonite... just like proof they make money from trading.

I am never sugarcoated... many times bitter to the taste, just like strong medicine. There is no need to collect scars and horror stories like me. My job as your Mentor, is to protect you along your development. To present you every advantage and shield you from the possibility of self-inflicted harm in your learning and practice. Will I be 100% successful in this endeavor? No. Some will not listen, some want the scars and think of them as badges of honor, like ICT tattoos that bond us together like brothers and sisters in the markets. The wise will listen and tread carefully where I point... and not at all in the periods I say not to.

When students, typically new pupils, fail to listen... they hurt themselves. Naturally, they do not want to assume the responsibility of their own actions. So, the natural response is to attack the method, the Mentor or model... and not the sole reason for their own predicament, namely themselves. Therefore people quit under me... because what I teach is not easy. It is not easily taught by others; it is not fast tracked in its entirety by others... that is a sales pitch by unprofitable liars... period.

I know what months I will not likely be profitable. When have you ever heard anyone tell you that? It does not happen. Why? Frauds must keep the illusion of superiority over the competition... and to admit frailty is weakness in their eyes and in the witness of spectators.

Knowing your limitations and not forcing yourself to perform in those instances, is wisdom. It is a testimony to experience, something 99% on the internet do not have. I know when I will lose... I know when I will win. Take a moment to digest that for a moment... and I understand that is a hard saying. It is, however, a true statement.

The hardest task for you, is to stick to the process. It is easy to quit. Many do it. Many try to return later... and there is no later now. There is a huge number of you that are about to embark on this journey with me... tomorrow. I am certain you are just as excited as you are nervous. This is normal... this is reasonable. Relax.

There is a lot of content that you will be expected to consume. There is no pace that you must keep up with or "group" that you must race to keep pace with. Do not fall victim to this illusion. Be mindful that you are investing in yourself... and be diligent with your studies. Do not be overbearing or unrealistic. Take in a little each day... it is easy to overwhelm yourself. Above all, try to enjoy the journey.

If you make it all study no fun, it will wear you out fast. Do not think you have to understand it all on the first mention of the concept. I teach in layered lessons, as it is the only true way to see how it all ties together. When you look back, this will make more sense to you, as it won't right now.

Patience, submission to the process and the time required for "you". That is your responsibility... leave the rest to me. I got your best interests in mind and I know how to deliver it.

Now rest up... you have work to do soon.

As you were...

____________________________

January 26, 2021 09:45 am ESTI can trade in lower timeframes every week & daily.

I prefer to trade when the HTF order flow is one sided. As it is right now... it is not.

I teach how to find that condition.

This is the basis to my motto "Every Week, Every Day..."

_________________

January 26, 2021 11:22 am ESTDay 27 - New Beginnings... aren't they so exciting?

Sometimes, we hold on too tightly, to what we think we know and what we believe we have; and we lose sight of all that could possibly be. We drown out our desire in favour of comfort, and we dull the voice of our heart... as fear settles in.

However there is nothing more beautiful than a new beginning. It offers fresh hope and a sparkling new perspective on life.

Letting go is a deep, misty and winding path of internal reflection. It is a brave solo journey, so appreciate and celebrate each and every small, tentative step you take ahead...

Know that I am blessed to relive these moments with you.

Excelsior!

___________________

January 27, 2021 08:22 am ESTDay 28 - There once was a group of children, who met for weeks to devise a scheme to steal from the ogres in the mountains. The ogres that lived in the mountains were rich and typically stole money from the people that lived at the base of the mountain.

Word of the scheme made its way to the ogres and they devised a scheme of their own. When the children thought to buy weapons to hurt the ogres, the ogres secretly sold the children the very weapons they hoped to overcome the ogres with.

The children were not aware of this, and foolishly they marched and chanted in their haste. They actually believed they had an edge over the ogres, that they would be victims of the children.

Little did the children know, the ogres were profiting from the scheme the children devised. They profited by inflating the costs of the weapons the children purchased to harm the ogres and they did not understand the limitations of the weapons they purchased.

The children felt empowered and formidable as they marched on the mountain and eager to take down the ogres. All the while, the ogres were laughing amongst themselves as they did. The ogres held control of the weapons and as the controllers, they held the power to make the weapons of no effect.

When the children thought they were going to be victorious over the mean rich ogres, the ogres ended up devouring them all... and growing evermore rich in the process.

This is a short little story I just made, up to illustrate my view, on the narrative you might be reading and or hearing about in recent days. When people think they are the reason a market prices to the levels it prints... this is illustrating infancy as a speculator.

Imagine, if you were an "ogre", I know it sounds repulsive, just work with me here. Imagine, if you were a rich ogre... and you heard that a band of children were planning to buy stocks with the intent to "hurt" you. You being more financially prepared and in an elite position to control or "make the market", these children were planning to buy... what would you do?

You would offer ridiculous prices at such a lofty premium, that any share count purchased at these levels would mark to market the stocks. The small crumbs that the children purchased were used to build in a pump and dump scheme... while the rich like you, who purchased large blocks prior to repricing and bidding it higher... actually made the real profits.

In short, the market makers are using these people to sell them their shares they purchased ahead of the pump... and yet, these people are laughing like they hurt the rich. No dear... you fell for it again... and made them even richer. Thanks for playing.

Yes... reality is cruel but efficient.

#GME, #AMC, #TheMarketEfficientParadigm, #RealityCheck

________________________

January 28, 2021 07:35 am ESTSo you see now, there is far more to it than my YouTube channel teaches. There is far more content than you expected. You see there is far more depth to what you enrolled to learn... and it is far deeper and more powerful lessons to come.

See what GbpUsd did overnight? Random or expected?

You will see how these signatures and specific points in Price Action, will frame consistent setups that yield handsome pips... every week. It is important to avoid chasing the profits these entice you with, while learning.

It doesn't look like much in a passing glance, but it was 50 pips.

Trust the process... all in good time, all in good time.

_________________________

January 28, 2021 08:05 am ESTI received a flurry of excited, thankful student emails overnight. I am unable to read them all, but I skimmed through a few of them. I appreciate your time in writing them, I eventually get to them... but it might be months before I do.

Resist the need to send emails, it makes the backlog all the more larger. I understand you feel like telling me thank you... reserve that until you are Charter level. You are feeling a sugar high right now... the work ahead will burn that off soon.

_________________________

January 28, 2021 08:12 am ESTUntil then, study this morning's Employment number volatility in 10 minutes.

__________________________________

January 28, 2021 08:20 am EST1:05:00 mark to 1:07:10 mark in last night's commentary. Listen closely... we will cover this today.

Crucial lesson in using my commentaries and lessons... aka. "the work".

___________________________

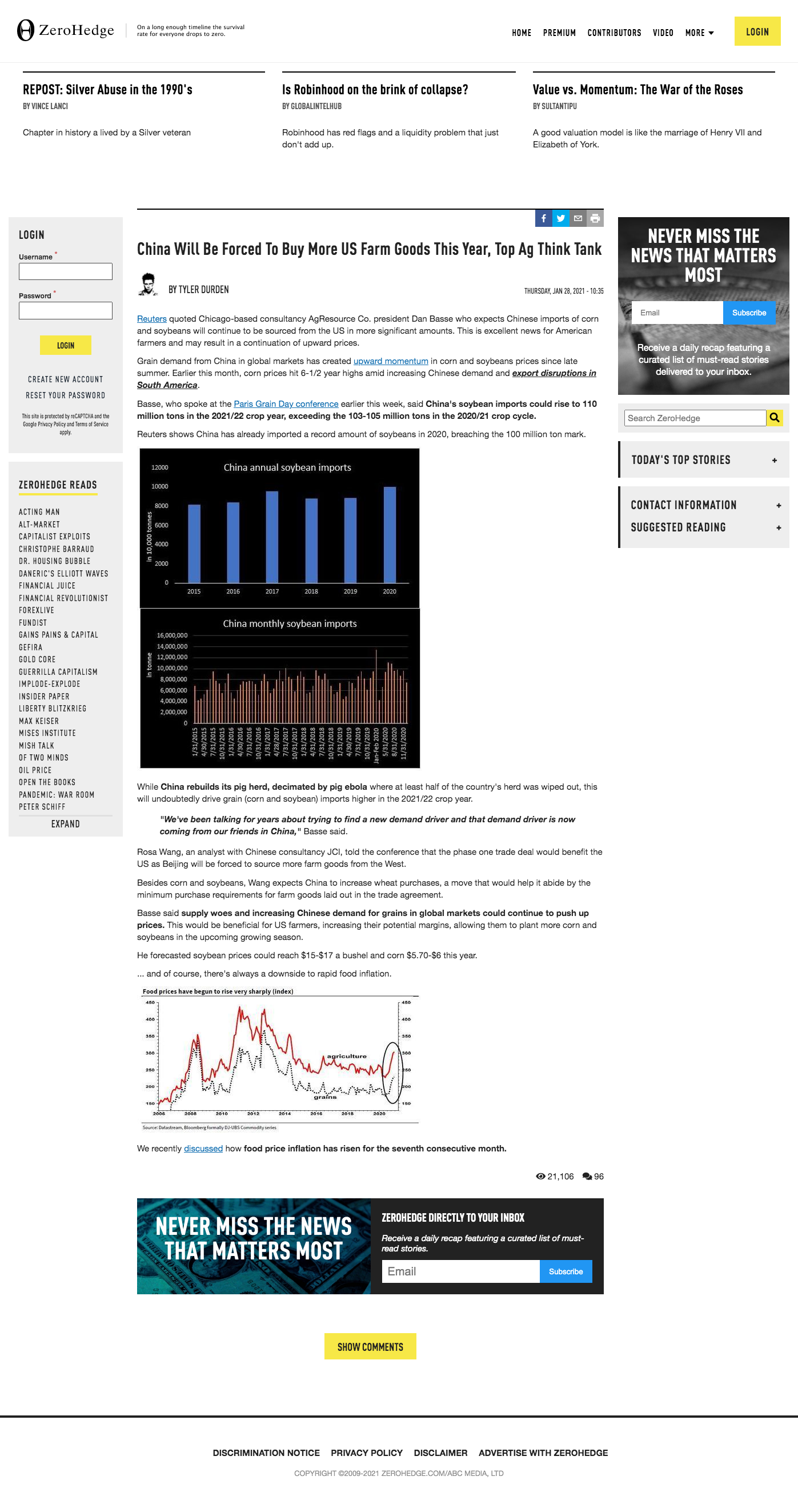

January 28, 2021 11:02 am ESTJust read an email from a reader, and he was surprised to read the headlines about China and grains. Now where did I hear that before?

Tomorrow's news headlines, from the charts. It is easier to believe than Time Travel.

As you were...

_____________________________

January 28, 2021 12:18 pm ESTToday's news... https://www.zerohedge.com/commodities/agresource-expects-china-increase-purchases-us-farm-goods...

One month before the move and the news.

________________________

January 28, 2021 12:22 pm ESTProof... I am still struggling to find some for you... hang in there. I'm certain some will turn up, eventually.

Imagine all the average people who bought AMC, GME, BB... trying to game the market.

Today they found out who runs what. Tik Tok will be interesting over my Wife's shoulder this evening. ;-)

They kept buyers and sellers from executing in them, I read. Now... tell me again there is no manipulation, no market maker, no rigged markets.

Everything is coming out now because control is obtained. Play by the rules... or not at all.

Be the unexpected. Don't let them see you coming. Draw the least attention. Win and make no fuss about it.

As you were...

____________________

January 28, 2021 01:00 pm ESTDay 29 - Many of you are feeling that January effect I spoke of, aren't you? Consolidation, short term chop, back and forth action.

This is typical, so do not make more of it than that.

February will loosen up and more liquidity will enter the market. Be patient... we've been here many times. This is nothing new or is it any different from the norm.

Enjoy your weekend... be safe.

As you were...

_________________

January 29, 2021 11:48 am ESTDay 30 – It is Saturday once more Constant Reader. As for the markets, we have closed the books on the first month of 2021. Already, Monday begins a new month… of February. Time doesn’t feel so formidable now, when you look back at New Year’s Eve, does it? The past few weeks went by at a staggeringly different pace for many of you.

For some, it has dragged on like an eternity and for others… it flew by in a snap. The difference between the two perceptions is pain. Some were impatient and kept counting down to starting a profitable year with every new rushed trade. Others were excited to start really learning how the markets book and more about themselves. One group focused on the money; the others focused on the “Process”.

Typically, it is about the time when New Year and New Resolutions diverge from one another. Many use January 1st each year to begin a new routine, diet or direction in their lives. Only to discover they only had a passing thought about it… and not really a conviction or a strong will to see it through. The effort and work that is required become too much for them and they chose other things to occupy themselves. They distracted themselves quietly… day by day, these past few weeks.

They are not trying to recall their resolutions on exercise, calorie controls and financial literacy for 2021. No, this is too uncomfortable for them… they are going to watch Netflix, YouTube videos and Instagram to live vicariously through others… while change evades them personally.

Then there is you, Constant Reader. Those who chose to make a lasting effort to change your present trajectory in life and you chose success. You were not discouraged these past few weeks, you grew more in your learning, your patience and you pruned the time-wasting things that hold your development back. This is commendable and you deserve a pat on the back. The majority in the world with new resolutions have already returned to their lazy routines and subconsciously accepted the life they live.

The new month of February begins on Monday. Make a short list of three things you want to start doing daily, that will feed your development. For some it will be daily chart logging and annotations for your Study Journals. For others, it will be just getting through another video or two for study. Then there are those who will be managing those 1440 minutes more efficiently this year… on a day by day basis.

February will fly by, before you notice. It is the shortest month of the year but for some, it will still feel like an eternity. The adversaries, obstacles, the barriers before them… will make it feel like an uphill climb. Strangely enough, you have the same things before you. You have a mountain of content to consume over the coming year, you have a ton of daily routines to forge and studying. All of this, plus your daily living responsibilities and family expectations. Why are you not thinking it is too much and that you should just let it go?

The reason is simple… you know you deserve it. The rest did not feel and don’t feel they deserve a more purpose driven life. The two groups both see the same efforts required and time to get to it. One group sees the odds and thinks to themselves… maybe next year. The group you are in sees just another rung to grab a hold of and some effort required to climb higher. You are not satisfied with the view you have right now… and that is a good thing. You chose to climb higher and avail yourself a new perspective on yourself, your passions and your life… and you already labeled it “Success”.

Like an unborn child, parents decide their child’s name. They have already cast forth a vision of holding them in their arms, talking to them as they stare in wonder into those big, beautiful eyes. Like those excited parents to be… you are soon going to birth your own “Success”. The child of your efforts, beliefs, passion and purpose… will be born to you. Like a parent, the birth takes time to get to and it comes with pains. You accept this, like a parent, because the reward is far greater than the uncomfortable labor of bringing the child into your arms.

Just like a parent, once you birth your success, you will have more responsibility placed on you. This is going to be things like, organization, routines that keep your progress on track, money management & not overtrading. These are things you must plan for as a lifestyle. It is not a lottery windfall in trading that removes the need to concern yourself with any of it.

Success is a child that demands your undivided attention. It is not going to tend to itself, it is not going to work by itself, it must be managed twenty-four hours and a day, seven days a week… with no days off. Just like parenting… it takes a ton of responsibility.

Fall in love with the process, like the process that yields the child. Fall in love with the vision of you holding your success in your own arms. Cast forth a vision of you and your family operating in this purpose driven life… and the ability to bless others in your abundance. This is the key to being wealthy and happy.

As you were…

_________________________

January 30, 2021 09:20 am ESTDay 31 - It will soon be Twilight on the last day of January. The sky is thick and grey, as the snow has began to fall here. Many like to see sunny skies and warmth, but I prefer the overcast. It is comforting to my eyes, as I am light sensitive... and these days are a gift to me.

My staff and I have noticed an increasing fever to get my spin on the recent stock market shenanigans. Let me remind you that we are in unprecedented times. You are going to be told things, that may or may not be true. Take everything you read and see in the "news", and season it with some salt.

What do I mean? Think about the storylines, who would benefit from the belief or nonbelief of the narratives. I tend to discount 99% of everything that is spoon-fed to the public... but that is just me. It doesn't mean I am always correct... I just refuse to be cattle... or part of the herd.

Stocks are artificially held up right now. Earnings are weak, a handful of companies are making money... the rest are failing or about to go out of business. If there is going to be a global reset, and I leave that up to you determine, for yourself Constant Reader... think about 401k plans. We seen 2020 ravage the landscape of business and commerce, except the corporate giants and tech companies... which exploded in profits. The smaller chains and family businesses are gone in some instances. Those that remain are on life support of savings, that is soon to run out.

Imagine, if there was a Tom Clancy novel that spun the tale of a global reset. Now imagine, the same things we seen in the past 4.5 years were part of this novel. Consider if the storyline was based on a Global Reset by a group of secret society that was hell bent on global domination and dominion over everyone, in every nation. How would that operate in the US?

Ask yourself... where is the money? Where is the last pool of money, in the United States? In its citizens 401k plans. Back to the hypothetical Tom Clancy narrative... how might that be used in the plot? As unreasonable as it might seem, at the surface, imagine an enormous stock market crash. What leg would the US citizen have in that instance? What if their 401k, of which they look to as their "insurance policy" or "financial life vest" - was eaten up by the proverbial stock market moths?

What resistance would remain... to ideas like, universal basic incomes? What resistance would be forged in the absence of American 401k cushions? There are many who have some money stuffed into these accounts and feel comforted in knowing, should all hell break loose... they and their family have some money socked away... just in case.

I ask you Constant Reader... what happens when this 401k safety net is removed? What if it will not protect those who trust in it? Would this be a facet to the agenda in our Tom Clancy novel plot? Would the readers shutter to think, "what if that ever happened?". Being fearful is not something any of us should be... after all, we are only talking about a hypothetical book plot... it isn't like the world is actually upside down and global economies are about to crash and usher in an entirely new monetary system... right?

More on this book plot... what if the villain's plan was to force everyone into submission to universal basic income? How could they force the new breed of wall street neophytes that wield their cell phone pitchforks and march on the financial elites castles? Maybe a sudden crash in the stock market... to the tune of say... 75%? Would that scare the living hell out of them? Would it make them second guess clicking their phone app to buy stock shares they read about on social media? I am asking you Constant Reader... I do not claim to know... I just want to retort with questions of my own.

If the average person is made to fear trading, or the industry increases limitations and margins to participate, this might affect the hordes ability to wage war as well. If you believe that narrative is in play... I don't. I see a perfect excuse to blame someone else, something else... for a failed economic policy and policies that are quickly blowing on the winds from a soon to be 51st state of America.

Propaganda is intended to shape the opinions and minds of the masses. It is not going to shape the minds of us all... but for the majority... it has been and will continue to be effective division and distraction. You are watching another psyop being perpetuated on the American population and people are buying into it... hook line and sinker. When the inevitable unfolds, the administration will have a perfect excuse to shuck the blame on "those radicals with their illegal stock purchases" causing the economic collapse in the US Stock Market... not a phantom germ that only attacks people who walk about maskless, but spares you if you are seating before your meal plate. How remarkable germ warfare is these days!

This Tom Clancy novel would be a New York Best Seller... I am certain of it.

Scent of the day... Carlisle by Parfums De Marly

As you were...

_________________

January, 31, 2021 10:00 am ESTI told you I didn't teach everything on my Order Block Theory... you will learn more this year. The rules for them as well.

First mention is not its entire teaching. Here a little, there a little. Layered illustrations is the only way to learn it correctly.

Everyone wants to think of it as easy as knowing the human brain resides inside the skull and by knowing this much... you are qualified to perform brain surgery.

Clearly, you need to know the connective tissues and the skin and nervous system and arteries... or the operation will result in a trip to the morgue.

Think.

________________

January 31, 2021 11:52 am ESTNow it is getting interesting...

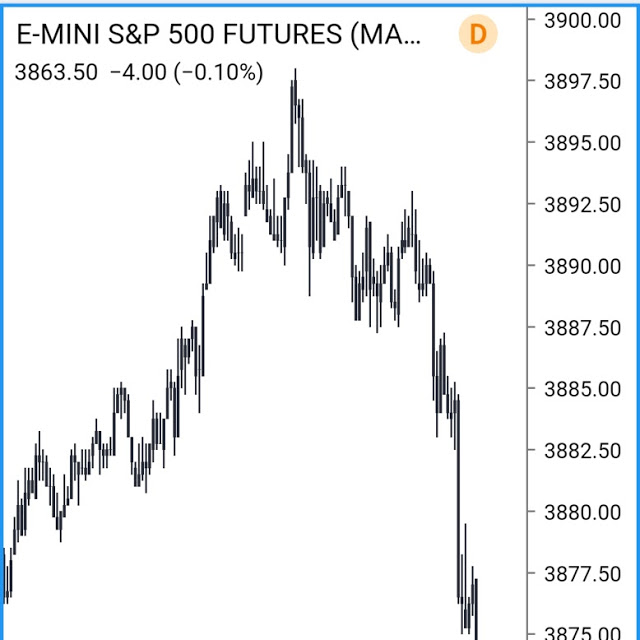

Day 32 - Algorithmic Theory is crucial to understanding IPDA. You have to practice many things to get experience with it.

I outlined things I would like to see and today you will see how you can execute in practice with it. Process, Theory and application.

Talk with you in a bit...

__________________

February 01, 2021 01:29 pm ESTI know I said the daily uploads would be about 5 minutes each... today might be 10 to 15 min, just because.

Happy 1st of February!

If you only learned how to make 20 pips a couple times a week, would you feel like a failure? If you only made 50 pips per week, would you think that you fell short on success? If you only made 3 profitable weeks a month... is this a sign of unprofitability?

Each of you have an idea what "your" success will look like.

It doesn't matter if anyone disagrees with your idea of your success. Keep others from having a say in the matter... keep it to yourself. They aren't spending your money.

__________________________

February 01, 2021 05:23 pm EST- What Do You See?

So, that is a typical 15 minute video... an hour in duration.

Translation: Value.

Now don't get spoiled with me doing all the legwork... you should be doing it as well and checking your annotations against mine. Don't waste this year by only spectating... roll up your sleeves and get to it.

Many of you are just only now, getting the onesided remarks I make here. You see the things I don't share here... and it gets better.

This luck stuff keeps happening... now you too are a believer.

Smile and wave... just smile and wave.

____________________

February 02, 2021 05:29 am ESTLike you shouldn't possibly know these things and yet you do?

Who is going to convince you now that I am a fraud? Who convinces you that it is all hindsight?

Welcome to the "Inner Circle"... my new students... welcome to the beginning of a whole new outlook on everything.

Pay The Trader.

As you were...

__________________

February 02, 2021 05:38 am ESTDay 33 - It is important to remember the week of NonFarm Payrolls is a week that is highly manipulated.

As such, we aim to find our setup early in the week or not at all. It takes discipline to adhere to... as you think, "there is still time to trade".

Everyone can trade as they wish... professionals choose to trade "sure things"... over gambling.

Who says you need to trade after today? No one worth listening to. Stick to the rules, accept the fact that you will not trade every swing... and it still will be more than enough.

It is crucial that you have limits on yourself initially. Otherwise you will get drunk with winning and lose foolishly in pursuing your next win high.

Grant yourself permission to be content now... study the remainder of the week.

Be safe...

_____________

February 02, 2021 06:27 am ESTHere is the reality of it all Folks,

Many are just seeing, for their first time, how a classic Pump and Dump in a stock occurs.

Newsflash, this happens every three months. It doesn't get noticed because the suckers that get caught in it... want to hide it from their friends and neighbors. You have not witnessed the tides turning... or the "lil guy" sticking it to the market... no, I am sorry.

This Gamestop stock story is nothing more than a Pump and Dump. Everyone was told to pile in on it at 350 per share and above... and this is how the ponzi pump and dump works.

Don't be a sucker. Seriously.

When there is rumor that a lot of buyers are interested in a stock... the market will test this idea and try to build a bid around it... and you witnessed just that. Nothing more. The real smart guys sold already... when Tik Tok, Reddit and the rest are pumping it to the public to sell their shares to at premium pump prices.

I realize it makes for a cool narrative, a storybook idea... but it will hurt you. Stick to trading strong issues with real earnings and you can make huge gains and sleep at night too.

Or don't and regret it. Choices... we all make em.

As you were...

I respectfully ask that you take that as my final word on the GME stock story... it is not smart nor money.

Sincerely.

________________________________

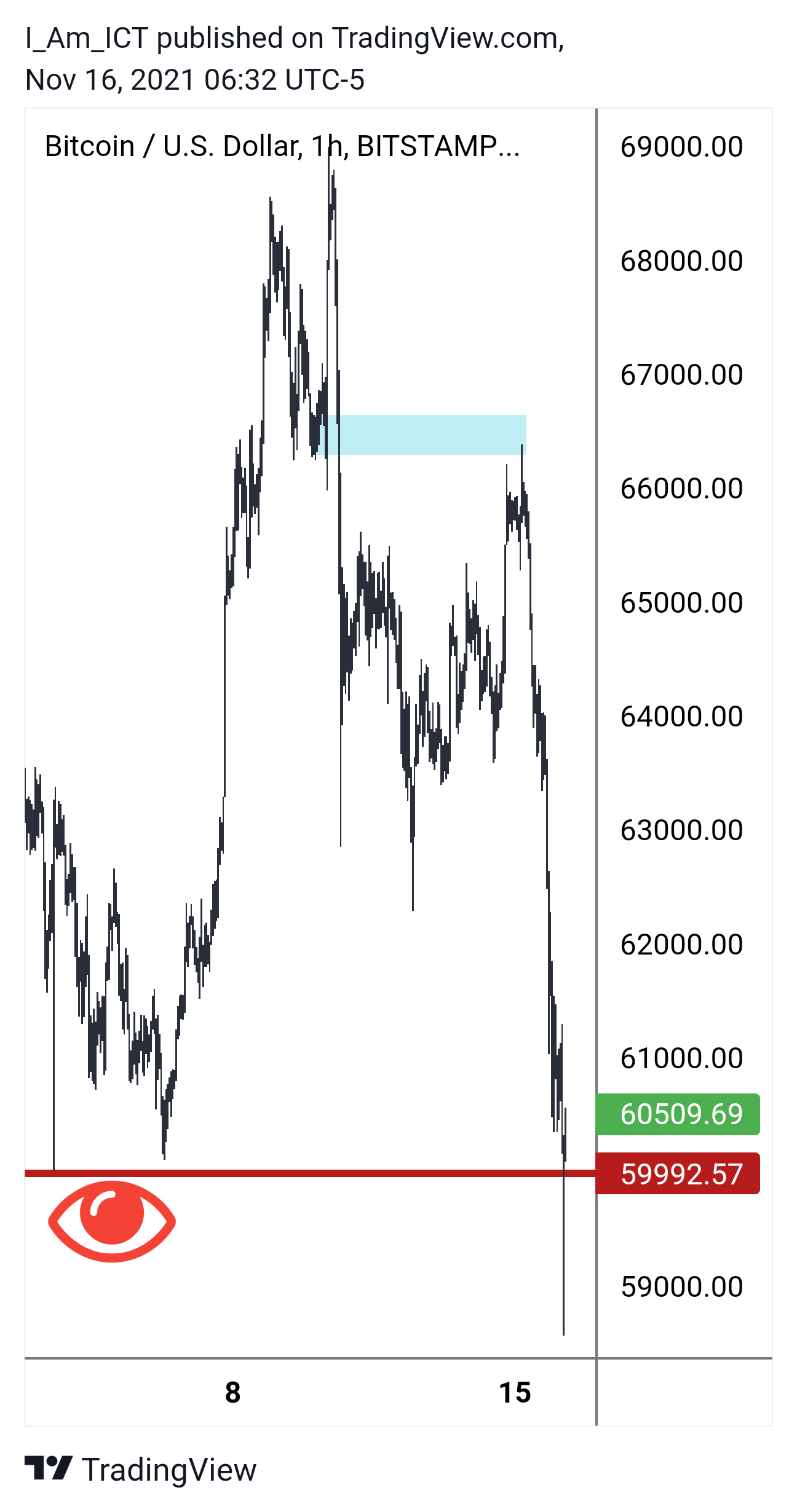

February 02, 2021 09:36 am EST- ... but like Bitcoin in 2017, I will be the bad guy and Fuddleston... like that? Just came to me

Study the previous post before opening this link, or you lose the opportunity to test yourself...

[space for spoiler]

https://www.tradingview.com/x/rxkeF8y7/Day 34 - Still blessed and highly favored.

EurUsd has performed to script. I believe I have won the trust of the legion that has recently just entered my fold. See the difference now, don't you?

We are done for this week. Exercise patience now... observe with no expectations on Price. NonFarm protocol is followed from here to Friday's Close.

Scent Of The Day - Explorer by Mont Blanc

As you were...

_____________________

February 03, 2021 07:33 am ESTHundreds of years from now, there will be books written about the very things I am revealing to the Trading industry.

The difference being... I actually called the moves beforehand and not just explained it away in hindsight logic and label it "Smart Money" in charts.

I am breeding real "Smart Money". I am creating Market Mavens. I am equipping hundreds of thousands of families to eat from their own hands.

You bear witness to it... and none of it is hindsight or borrowed or repackaged logic. You are part of history... this should excite you.

The daft will.read this and see "arrogance"... I leave them to that.

Be safe.

_____________________

February 03, 2021 07:47 am ESTOkay ICT, you show London, New York Killzone setups...

What about the Asian Open?

Study the first link, What Do You See?

https://www.tradingview.com/x/NPQvb0bT/

[space for spoilers]

When you are ready for the notes overlaid on the chart, click the link below

https://www.tradingview.com/x/DSKqr5BC/

Some will think this was an afterthought... that's cute.

The Voodoo that we do...As you were...

Day 35 - The comfort of knowing... that is a hard thing to translate to those who don't know. No matter how I try to communicate it, it will never reach high enough to satisfy my intentions... and it will fail to inspire others. It is a personal realization you obtain from experience.

The experiences, you are collecting, are shaping your perspective on the markets. The incorrect form of development is to impose your myopic opinions on what you want, versus what the markets will reveal you need. This is a major crossroad for every developing Trader.

Some choose a path that looks full of glitz and attention seeking, others choose a low key path. The successful do not focus on the outward appearance of themselves or the "look" of a Trader. They want to know, that they know, that they know. Image is nothing, results and consistency are everything.

When you understand when you are less likely to be successful and you are new at something, this can be interpreted by internal dialogue with yourself as... failure or needless suffering. It is easy to want to escape this feeling and the surest way to do that is to "ring the bell", or quit.

Let me just remind you, quitting merely replaces uncomfortable with regret. Both are measures of pain... one is temporary albeit piercing... the latter is lifelong and a dull ache that never relents. Do your best to accept the temporary discomfort of not knowing... right now. These lessons are harvested over months and years... not weeks and days.

When you understand when you are likely to fail on the short term, this provides protocols that enable you to perform at optimal performance. In Trading, this is many times practiced in the art of "Stillness". Doing nothing, when it is the best procedure to maintain, or in your position, developing early success characteristics.

The markets will always have trade setups; some better than others. Like roses, they are lovely to behold and stop and sniff their fragrant scent... when you come upon them. However, if you foolishly grab them and try to take one home with you, you might get pricked by their only defense. They each have a thorn on their stem... it is not hidden, it is not kept from your view... it is in clear view.

Like many Traders who just want to take something home, like our rose analogy above... they get pricked. The market has a way of showing its "thorn" to those willing to look for it. Sometimes it is appropriate to take a rose for yourself in the markets... and there are other times, when it is just better to stop and only smell them.

As you were...

______________________________

February 04, 2021 10:12 am ESTDay 36 - It is NonFarm Friday... why are you still in front of your screens?

Enjoy the weekend, be safe.

___________________________

February 05, 2021 10:09 am ESTIt is okay... if it was a trading day, you'd still be up with me too.

#MonsterInTheMaking

__________________

February 06, 2021 03:38 am ESTDay 37 - It is Saturday once more and my view from my window is frosted with snow still. My mind drifts to the emails from my new students who shared their enthusiasm for the things they are witnessing. The corners of my mouth draw back ever so slightly, as I consider how little they seen thus far.

Their excitement and appreciation, for the things I am teaching them, sends me back to my early days - as a developing technician. I allow my thoughts to change to that of their dreams and goals. Are they now evermore in reach or have these first few weeks caused them to reevaluate them and stretch them even higher? This thought gives me more reason to smile, even brighter.

At any rate, I am pleased to be in an honored position as their Mentor. It speaks volumes, when a person devotes their time and energy on the things one says and instructs them to do. Lord, I ask that you give me wisdom to help those who may feel overwhelmed by it all, this early. It can be very intimidating... but I have faith, You will give me the means to reach them as well.

I think about the years, when I was just starting out... and feeling like I had to know it all, and immediately was a week late. Looking back now, I can see how crazy that was for me, to think and feel. It was impossible to absorb in the time I felt then, was reasonable. Despite the 6 to 10 hour days in relentless study and sleeplessness, plus still working a job.

While I am a man that most would label wealthy, I am rich because of the lives I touch and impact. I am a simple man from a small neighborhood that time has erased. The homes that once stood where they did, has long been rebuilt with new modern homes.

Friends that knew me as the martial artist, would never recognize me, if they heard me, teaching on the subject of the markets. I turn 49 years old this coming August 8th, and I can see the many seasons in my life. Of all the things I have done... teaching has been the most rewarding.

I open myself from time to time, with you Constant Reader. In some ways as merely sharing my inner musings or personal reflections. I guess, to somehow ground you and realign your progress and pace.

It is easy to stray off and waste time worrying about things you can't speed along or avoid... and it helps to have an old man put his hand on your shoulder and remind you... "I been there and you will be fine... keep doing what you are doing. It will come."

Perhaps, for some, my talks wouldn't feel so long and boring if I had my toys in the scene... or the bank accounts and homes. However, those things would drown out the message and those who feel they need that eye candy, would still fall short of the wisdom shared.

So I teach in modesty, despite my occasional ego trip against the many frauds in this business. I do my best to always speak to my students, like you, with tenderness and encouragement. This is what you need... not monetary flexing.